It’s been a rough start for the tech-heavy Nasdaq index as it fell -1.18% today. That comes after a -1.63% decline on the first trading day of the year (yesterday).

Today, the declines were broad-based with the Dow Industrial Average, the S&P index, the Russell 2000, and the NASDAQ all declining by at least -0.77%. The Russell 2000 of small-cap stocks was the hardest hit index with a decline of -2.66%. That came despite lower 10-year yields (at 3.912% and down -3.2 basis points).

What is clear is the market is shifting out of the gainers coming into the end of year as the flow of funds shifts.

A snapshot of the closing levels shows:

- Dow Industrial Average fell -284.85 points or -0.76% at 37430.20

- S&P index fell -38.00 points or -0.80% at 4704.82.

- Nasdaq index fell minus 173.74.4 -1.18% at 14592.20

The Russell 2000 index of small-cap stocks fell -53.59 points or -2.66% at 1959.20.

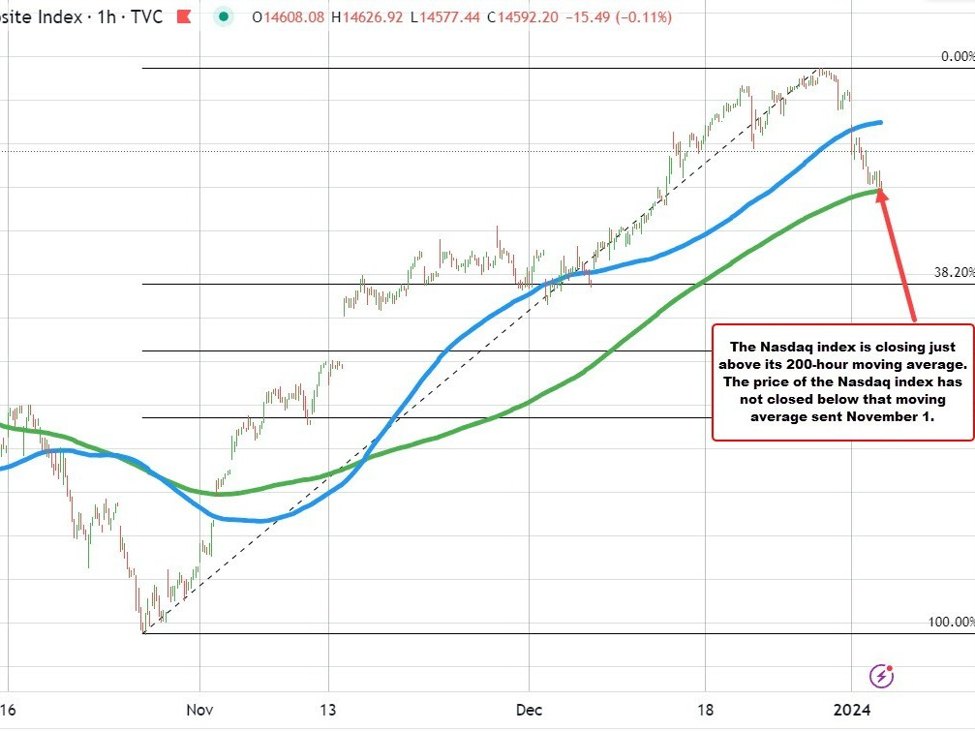

Technically, the Nasdaq index is closing just above its 200-hour moving average at 14585.18 (closed at 14592.20 but did trade below the level at 14577.44 intraday). The NASDAQ index has not closed below that moving out since November 1

Nasdaq index has dipped to the 200-hour moving average

Of interest is the S&P index fell and even -27.00 points on the first day of the trading year. On the second day, the index fell an even -38.00 points. I just find that a little improbable/interesting.