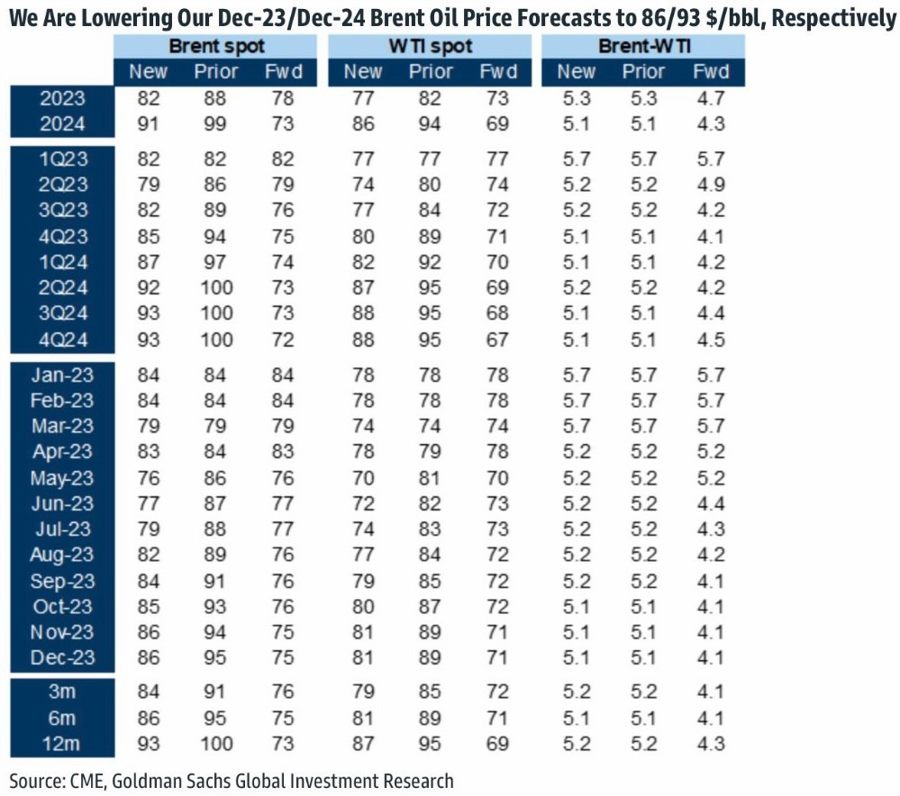

I posted earlier on this weekend’s crude oil forecast revision from Goldman Sachs here:

As further background to this change of call, Goldman Sachs Group Inc.’s Global Head of Commodities Research Jeffrey Currie spoke in a Bloomberg TV interview on Friday, making points that

high interest rates, which have pushed up carry costs by circa 13 to 15%, are bringing on destocking. Higher interest rates have made it too expensive to keep oil in storage and investor interest is unlikely to return until inventories start to decline.

and “You’re going to be seeing substantial physical inventory draws because of these OPEC production cuts, particularly in the third and fourth quarter,” he said. “That’s going to push us up into the low $90s.”