Sources indicate that UBS is close to finalizing a deal to acquire Credit Suisse, as Swiss and global authorities work to mitigate banking sector contagion and restore confidence in the financial system. The agreement could be reached as early as Sunday.

The Swiss National Bank (SNB) provided a $50 billion lifeline earlier this week, although Credit Suisse’s stock price, following a brief rally, declined once more. US shares closed on Friday at $2.01, marking a 24.44% drop for the week, with the week’s lowest price at $1.75.

Meanwhile, in the US, Silicon Valley Bank filed for Chapter 11 bankruptcy on Friday, one week after regulators shuttered the bank and guaranteed all depositor funds. Signature Bank was closed by regulators last weekend as well, after losing billions in withdrawals due to contagion from the collapse of Silicon Valley Bank.

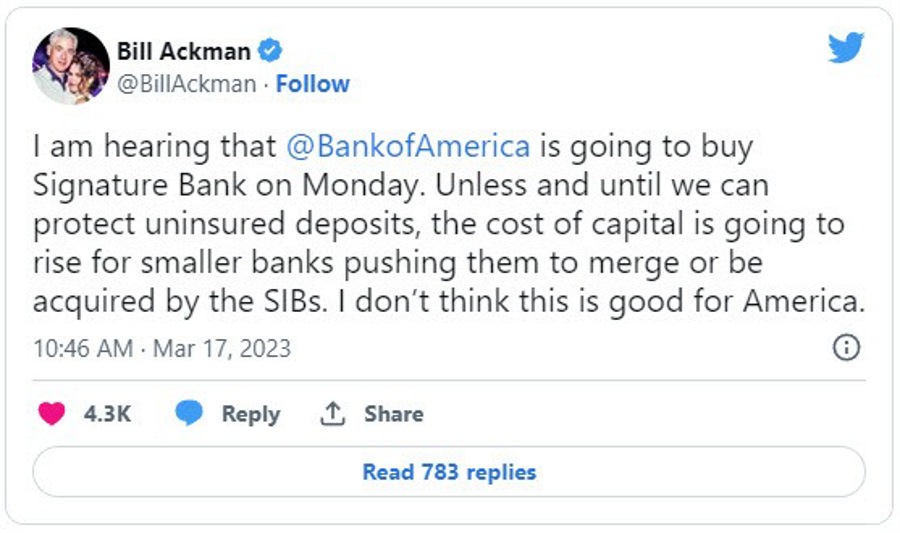

Hedge fund manager Bill Ackman tweeted on Friday:

A source familiar with the matter denied BofA interest in Signature.

First Republic’s stock price continued its downward trend on Friday, despite a consortium of banks depositing $30 billion into the bank just a day earlier. After hitting a low of $17.53 on Wednesday, the stock rallied to a high of $40 on Thursday. However, it reversed course on Friday, closing at $23.03, a 14.07% decrease. In after-hours trading, the price slid even further to a low of $19.49. Moody’s downgrades First Republic Bank to B2 from Baa1.