There was little in the way of economic data today, but there was some final Fedspeak to end the week. It also would the last opportunity for Fed officials to speak ahead of their blackout period before the Fed meeting and decision on February. Fed’s George and Waller were both speaking. George is not a voting member and is retiring in 2023. Her comments saw limited reaction.

However, Fed’s Waller was the main event as

- He is a member of the Board of Governors so he has a permanent vote,

- He hasn’t spoken since November. So what he said would be “new”-ish

- He is more of a hawk. So if there is a shift it could be positive for stocks, negative for the dollar

His comments had the usual playbook, but he did start by saying 25 basis points is good in February. He sees the rate moving higher and for the rate to stay steady in 2023.

However, he also had some positive things to say about inflation, but the most impactful comments was when he said that 2022 was humbling, and followed that comment by saying:

-

If markets are right and inflation is coming down, that’s great news. Would have no problem changing policy.

HMMM…Usually, the Fed members get on their high horse and say this is what we are going to do, this is what we expect. I loved to hear “humble’ and willingness to bend the other way, because it would be “great news”.

The US stocks were higher before his speech and Q&A with the:

- Dow up 0.29%

- S&P up 0.86%

- NASDAQ up 1.48%

- Russell 2000 up 0.76%

- 2 year yield 4.183%

- 10 year yield 3.488%

The yields are not much changed before and after Wallers speech. Nevertheless, the 2 year was still down -6.4 basis points this week and the 10 year down -2.6 basis points, even though the Fed is still looking to hike at least twice more in 2023.

In the stock market, the major indices saw some buying return on hopes “the market” will be right and the Fed wrong (and they humbly respect that).

So, the final stock numbers are closing higher, but for the week, the Nasdaq eked out a gain for the week (thanks to today) but the S&P and Dow were lower.

- Dow rose 330.91 points or 1.00% at 33375.50 today. For the week the Dow was down -2.7%

- S&P rose 73.74 points or 1.89% at 3972.69 today. For the week the S&P was down -0.66%. The index closing level was back above its 200 day moving average at 3968.87 which sends traders home happy for the weekend with hopes for more follow-through next week.

- NASDAQ index rose 288.18 points or 2.66% at 11140.44 today. For the trading week, the index gained 0.55%. It was the third week in a row higher for the NASDAQ index.

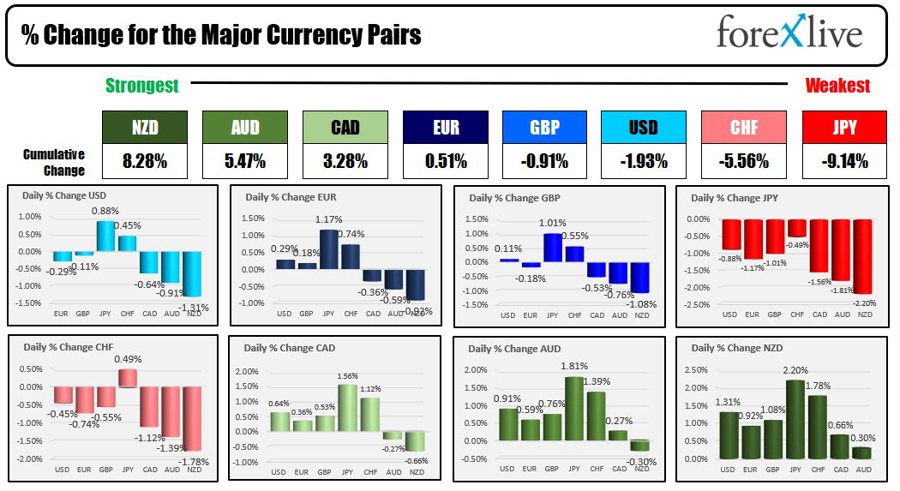

IN the forex today, the NZD and AUD moved higher helped by “risk on” flows. Both moved back above their 100 and 200 hour MAs tilting the bias back to the upside for each vs the USD. The JPY was the weakest. The USD was lower to mixed with gains vs the JPY and CHF and declines vs the NZD (-1.31%), AUD (-0.91%) and the CAD (-0.64%) leading the way.

For the trading week, the USD was mostly lower with the exception of a gain vs the JPY and unchanged vs the AUD. The USD saw the biggest decline vs the GBP (-1.44%) and the NZD (also -1.44%).

- EUR, -0.23%

- JPY +1.33%

- GBP -1.44%

- CHF -0.66%

- CAD -0.13%

- AUD unchanged

- NZD -1.44%