There was a flurry of data today before markets settled into the holiday week ahead that will have Stock and bond markets closed on Monday in observance of Boxing Day and Christmas and early closes next Friday and on Monday for New Years. The forex market will be open Monday to Friday as is customary, but with the economic schedule light and most traders taking the week off, the activity should be limited.

For year end flows (tax related), activity must be completed by Wednesday to get under the end of year wire.

Today the US had durable goods, Core PCE including personal consumption, Michigan consumer confidence and new-home sales.

Durable goods orders came out mixed. The headline number was weaker than expectations but if you subtracted out the transportation, it wasn’t so bad. Revisions were not so great though.

PCE headline and core inflation came in about as expected with the core PCE still up 4.7% but down from 5.0% last month. Included in that report is personal income which rose by a greater than expected 0.4% versus 0.3%. But consumption was worse than expected at 0.1% versus 0.2%.. Later in the morning, the Univ. of Michigan final reading came in at 59.7 up from 59.4 the preliminary. Both were higher than last month’s 56.8 reading. The current conditions rose to 59.4 from 58.8 last month. The expectations Index was also higher 59.9 versus 55.6. Inflation one year forward came in at 4.4% versus 4.9% last month. Although lower, it is still above the Federal Reserve’s estimate of 3.1% at the end of 2023.

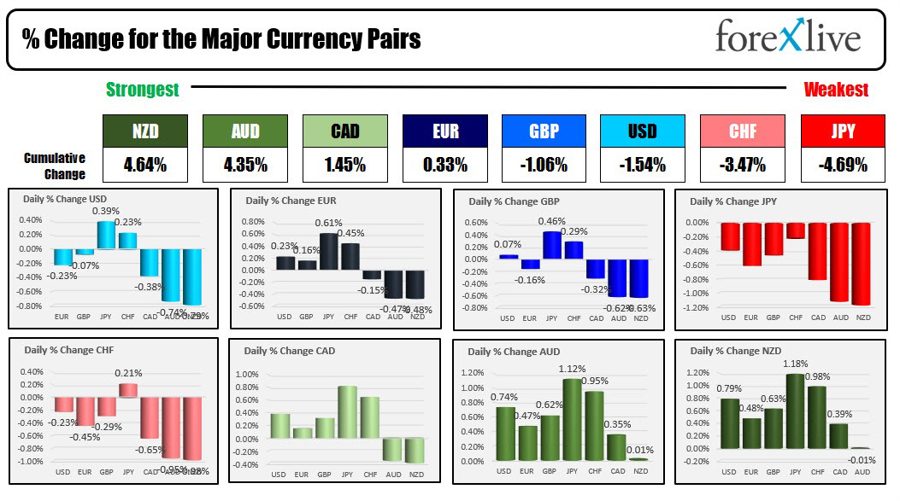

In the forex market, the strongest of the majors was the NZD and the AUD. The weakest were the JPY and CHF. THe USD was also weaker today vs most of the major currencies.

In other markets:

- spot gold is up $5.88 or 0.32% at $1798.04

- spot silver rose to $0.16 or 0.69% at $23.72

- WTI crude oil closed higher by $1.90 at $79.41

- bitcoin was steady and $16,814. It was near mid range of the day’s trading range

In the US stock market, the major indices worked their way from negative territory to positive terrritory by the close:

- Dow rose 0.53%

- S&P rose 0.59%

- Nasdaq rose 0.21%

- Russell 2000 rose 0.39%

Let me take this opportunity to wish you all a happy and healthy holiday season.

Joy to the world….