It’s cold in Europe right now and that’s going to lead to another big week of draws in natural gas supplies. The good news is that inventories are still high and that’s buffeted by some LNG ships off the coast of Spain.

Where it could start to get complicated is China coming back into the mix. According to Platts, China issued tenders to buy LNG cargoes starting in Feb and running through Dec 2023. Those are the first incremental buys since the beginning of the Russia-Ukraine war and is another signal regarding China’s reopening.

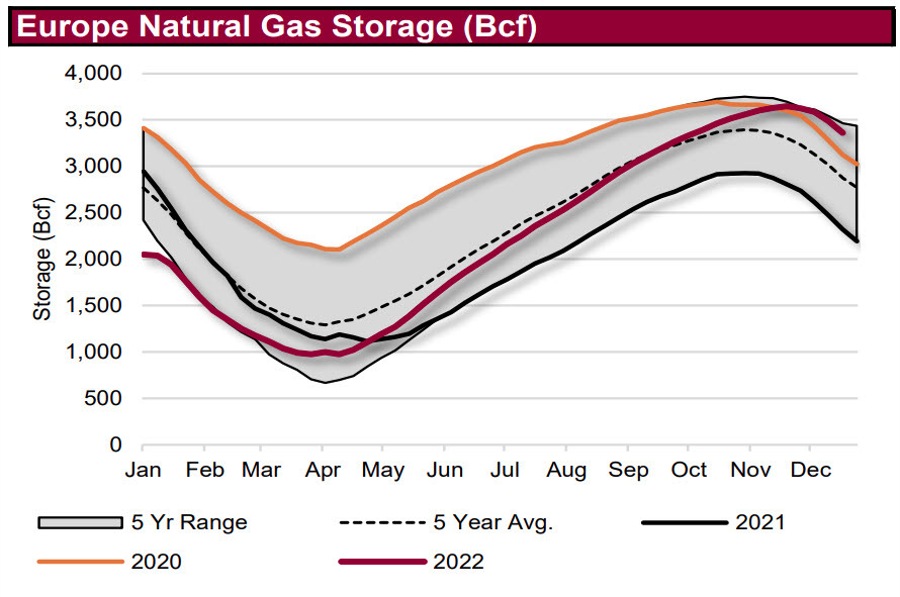

This is the important chart, as it shows the state of European storage.

You can see the herculean (and expensive) effort to fill storage starting in April of last year but some of that was with the help of Russian pipelines. Those are largely shut now and that also impacts winter flows.

Models right now look ok for winter 2023 but are highly variable and dependent on conservation (so far so good) and weather (Oct-Nov was great, Dec so far cold).

Assuming current trends hold up, it will get interesting again in the spring when efforts to refill storage get underway. If China and Japan are bidding, Europe won’t have the LNG market to itself. Strip is currently flat right through that period but it’s entirely unclear how strong competition will be for those molecules.

As for the euro, the costs are mounting. Yesterday, Reuters wrote about how Germany’s 440 billion euro ‘bazooka’ to short up energy supplies may not be enough. They equate that cost to 5400 euros per German so far. With the ECB jacking up rates further, the costs for governments and consumers will stay high.