It doesn’t take any deep analysis to see what’s coming in the auto market.

During the pandemic, there was a boom in auto sales and people paid way too much. Now the bills are coming due and governments are no longer stuffing consumer wallets. On top of that, interest rates are surging so the people who already tend to borrow too much (like many car buyers) are feeling squeezed from every angle.

Some are trying to unload the used cars but they’re rapidly-depreciating assets and suddenly the market for used cars is saturated. More pain is coming.

But there’s also an interesting thread by @cardealershipguy doing the rounds where he’s saying that lenders are offering loans for 2nd cars to people who can’t afford the first one.

“I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble. This will not end pretty.”

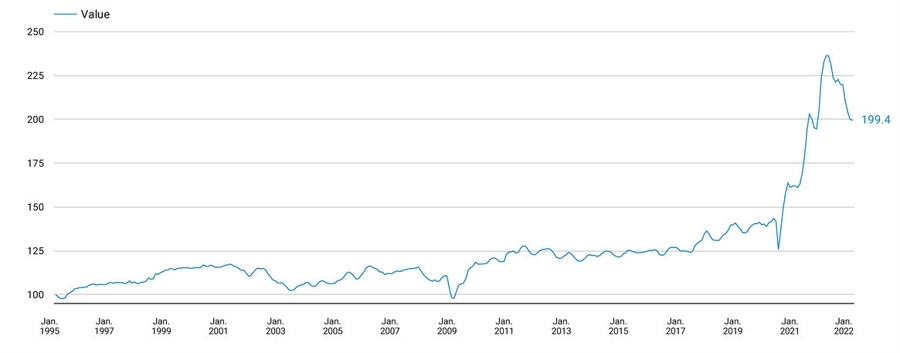

Remember that goods inflation started with spiking used cars prices last year and now that trend is already reversing.

Looking at the above chart, which is the Mannheim used vehicle index. It looks like prices could still have a long way to fall. With the Fed raising rates further, the pain will continue to mount.

This is one of those things where no one really knows how much excess is out there but in my mind, there is a certain (growing) segment of people that always max out on everything and have to have the nicest car. They’re going to be in big trouble but the bigger trouble could be banks. Yes, people might lose their cars but that’s not the end of the world, especially if they can buy another cheaper in a crumbling auto market (if they have any credit). The big losses could be with the lenders, who are repossessing cars worth much less than the value of the loans. In turn, they’ll have to dump those cars on the market and that will push down prices further.

In short, used auto prices could get awfully cheap next year, potentially even undershooting 2020 levels on that chart.

Worse, the lenders could find themselves in major pain. To some extent, I think the market already knows that because here’s Ally, which is the 2nd largest US auto loan originator.