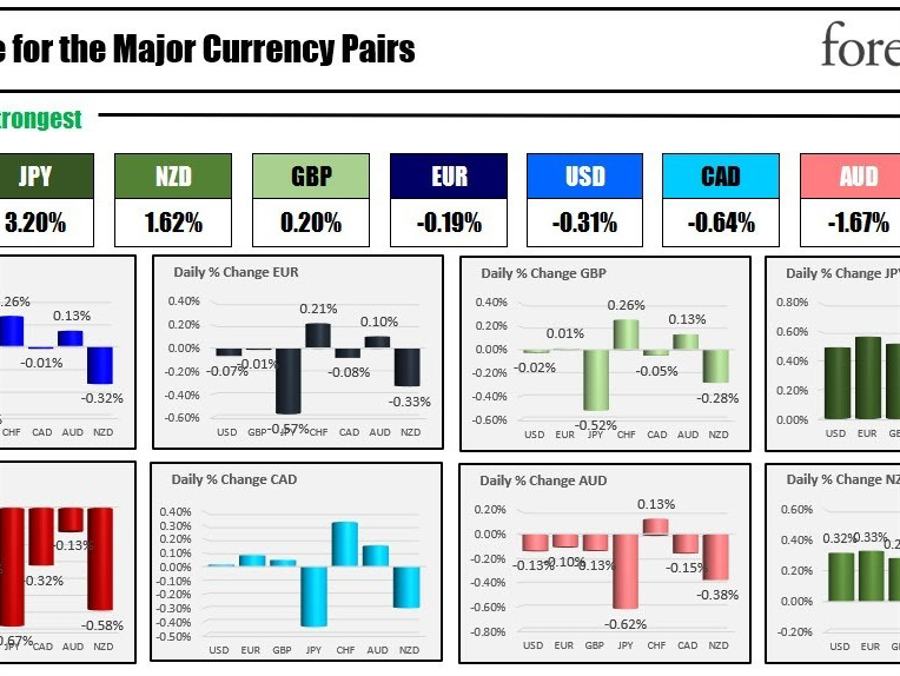

The JPY is finding the safe haven bid today after not finding it yesterday. It is the strongest of the majors. The CHF, a safe haven currency normally, is not finding a bid as it is the weakest of the majors today. HMMMM. The USD is mixed today after rising yesterday. The EURUSD is mixed today after its up and down day yesterday, as traders and investors first bought the EUR currency after the more hawkish ECB, then sold it when they turned the focus to the lower growth expectations. The data dump in Europe showed stronger flash PMI data, but values are still below 50. The UK retail sales were weaker than expected.

In other news, is Binance hiding things? The auditor that provided the “proof of reserves” has now paused all work with crypto firms. Bitcoin which was at $18K earlier this week, is near $17K now.

Goldman is laying off as many as 4000 workers as they struggle to make ends meet.

China covid cases are surging and fears of a covid slowdown as opposed to a lockdown slowdown. Oil is lower as a result.

The stocks are lower in Europe and in pre-market trading in the US after declines yesterday saw the Nasdaq lead the downside yesterday with a decline of -3.23%. Is the Fed hawkishness tilting the economy to a hard landing vs soft landing?

All the balls are up in the air, and not a peep about the Ukraine war which has been relegated to the back pages.

Happy Holidays?

A snapshot of the markets are showing:

- Spot gold is up $8.76 or 0.50% at $1785.30

- Spot silver is down -$0.15 or -0.69% at $22.92

- WTI crude oil is down -$1.72 at $74.24

- Bitcoin is trading at $17010 after trading as low as $16,928. The high prices week reached $18,373 before rotating back to the downside

Looking at the premarket for US stocks, the major indices are trading lower after yesterday’s sharp declines:

- Dow Industrial Average is down -341 points after falling -764.13 point yesterday

- S&P index is down -36.5 points after falling -99.59 points yesterday

- NASDAQ is down -63 points after tumbling -360.36 point yesterday

in the European equity markets, the major indices are trading lower:

- German DAX -0.56%

- France’s CAC -1.23%

- UK’s FTSE 100 -1.29%

- Spain’s Ibex -1.02%

- Italy’s FTSE MIB -0.3%

in the US debt market, yields are higher:

- two year 4.251% +0.7 basis points

- five year 3.658% +3.3 basis points

- 10 year 3.505% +5.6 basis points

- 30 year 3.553% +5.9 basis points

in the European debt market, yields are moving sharply higher once again with Italian tenure yields up 15 basis points leading the way