I’ve been questioning the EIA estimates of US oil production all year long. If you listened to the companies in oilfield services, there are no rigs, no pipe and no workers. Meanwhile, companies are being hit by inflation and pressure to remain disciplined. The ability to tap DUCs is basically done.

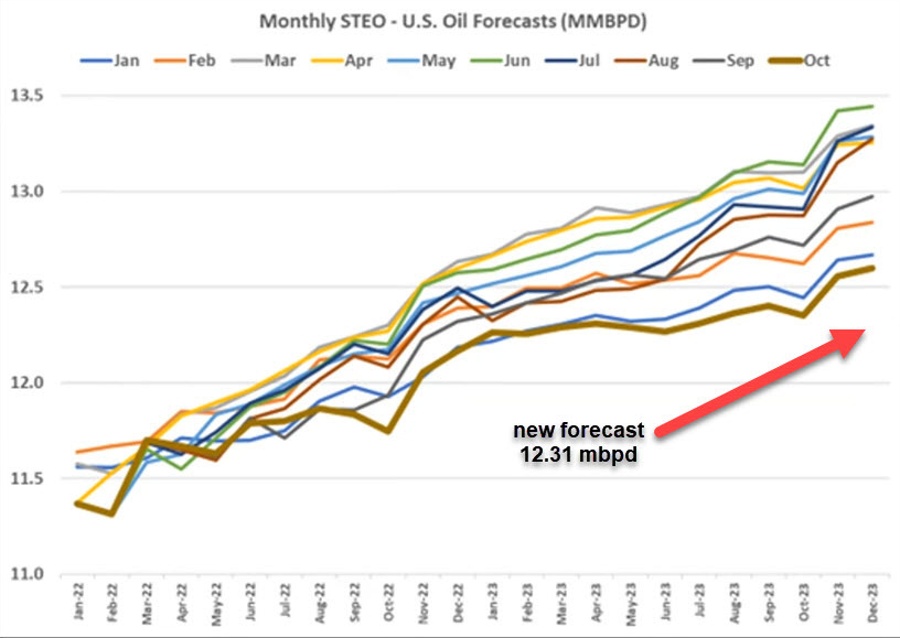

Since then, there has been downgrade after downgrade of US production.

Today we’ve gotten another round with the EIA revising 2023 US output growth estimtes to 480k bpd from 610k bpd, leaving US production at 12.31 mbpd next year.

That’s down from nearly 13.5 mbpd in June… that’s 1.2 million barrels per day of oil that’s not coming to market.

Oil has been the trade of the year in 2022 and with more headlines like this, it will be again in 2023. That said, anyone who was paying attention should have seen this coming.

The bigger question is how much oil is really available in US shale?

I highly recommend watching this bit on US output.