We’ve been writing about this for months and evidence continues to mount that the US Energy Information Adminstration has a data problem. When July demand data cratered, it kicked of a demand-destruction trade in oil but when the monthly numbers were revised, they showed that gasoline demand was 300k barrels per day stronger than reported.

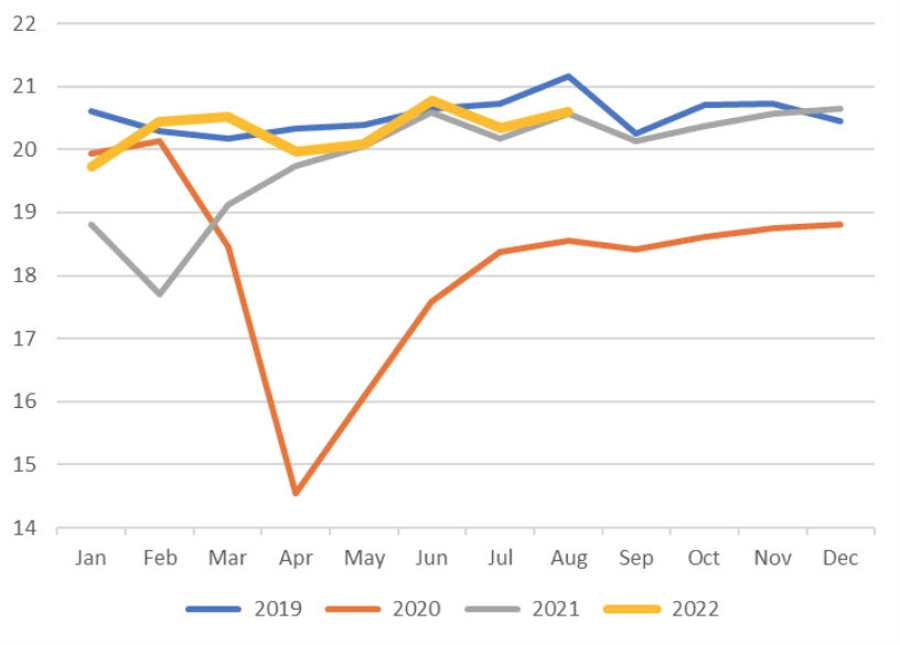

Today, August data was released and showed total oil demand at 20.601m barrels per day, up by 547k bpd from 20.054m based on the weekly numbers.

On the gasoline side, it showed that demand was 0.1% higher than last year, though down 2.6% from August 2019. (h/t @staunovo)

On the flip side, US production was revised higher to 11.975m bpd from 11.873m bpd, which is a 100k bpd improvement.

The overall message here continues to be that oil demand remains inelastic, even at high prices.