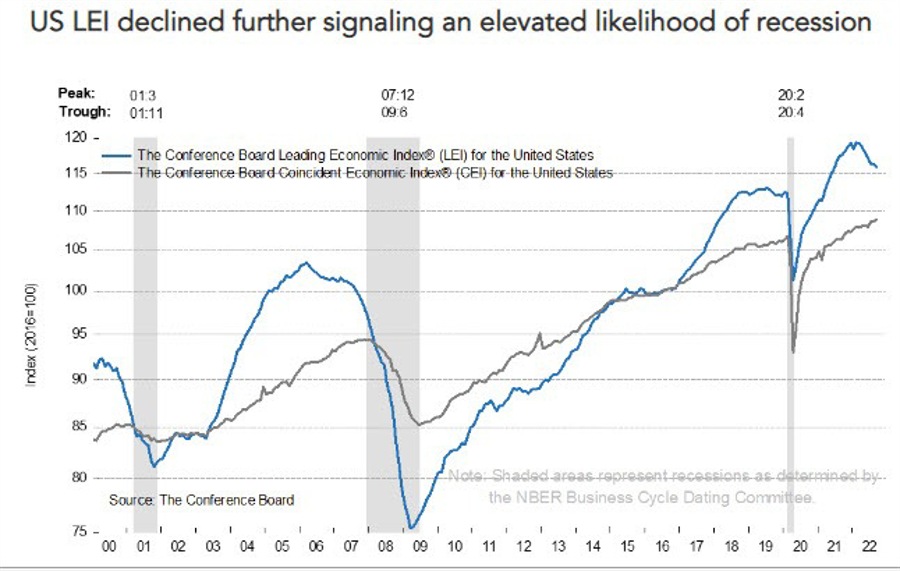

The US leading index for the month of September shows:

- Leading index fell -0.4% vs. -0.3%

- prior month was revised to 0.0% from -0.3% previously reported

- index comes in at 115.9 after remaining unchanged in August

- the index is down 2.8% over six-month period from March to September 2022. That is a reversal from its 1.4% growth over the previous 6 months

According to conference Board senior director of economists Ataman Ozyildirim said:

“The US LEI fell again in September and its persistent downward trajectory in recent months suggests a recession is increasingly likely before yearend. The six-month growth rate of the LEI fell deeper into negative territory in September, and weaknesses among the leading indicators were widespread. Amid high inflation , slowing labor markets, rising interest rates, and tighter credit conditions, The Conference Board forecasts real GDP growth will be 1.5 percent year-over-year in 2022, before slowing further in the first half of next year.”

For the full report click here

This article was originally published by Forexlive.com. Read the original article here.