Major

FX moved in small ranges during the timezone here today. The focus is

on getting the US non-farm payroll report out of the way, its due at

1230 GMT and there are previews in the points above.

-

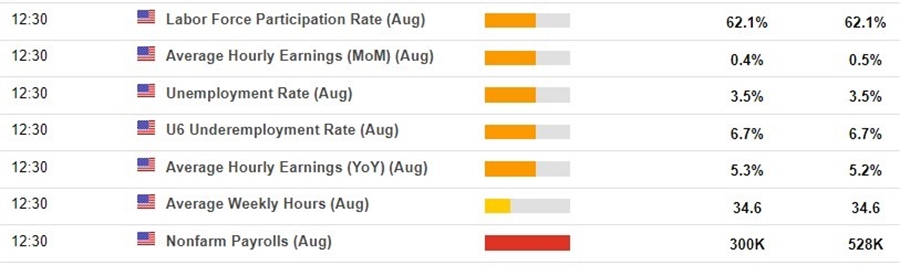

This

snapshot from the ForexLive economic data calendar, access

it here. -

The

times in the left-most column are GMT. -

The

numbers in the right-most column are the ‘prior’ (previous

month/quarter as the case may be) result. The number in the column

next to that, where is a number, is the consensus median expected.

—

USD/JPY

dipped briefly under 140 but soon found a bid again. This came

despite multiple officials in Japan weighing in with statements

seeking to support the yen (again, in the points above). Traders just

shrugged these off.

Early

in the Asia morning we had reports out of Iran that they had sent in

what they said were constructive proposals to finalise the nuclear

deal talks. Later in the session we had the US State Department saying

no, the proposals were not constructive. Oil has net risen on the

session a little.

The

People’s Bank of China set the reference rate for USD/CNY well

below the estimate again today (i.e. set the CNY stronger than

estimated). China is sweating on the risk of great capital outflow

from the country as they lower rates to deal with the numerous

headwinds for the economy:

- rolling

COVID outbreaks and associated shutdowns - a

deeply, deeply distressed property sector - power

shortages in key industrial hubs

In

response China’s FX regulator the State

Administration of Foreign Exchange (SAFE) issued soothing words on

stable FX flows. These were accompanied by smooth-talking from the

PBoC also, the usual ‘provide ample liquidity’, ‘no

flood-like’ stimulus. More in the points above.