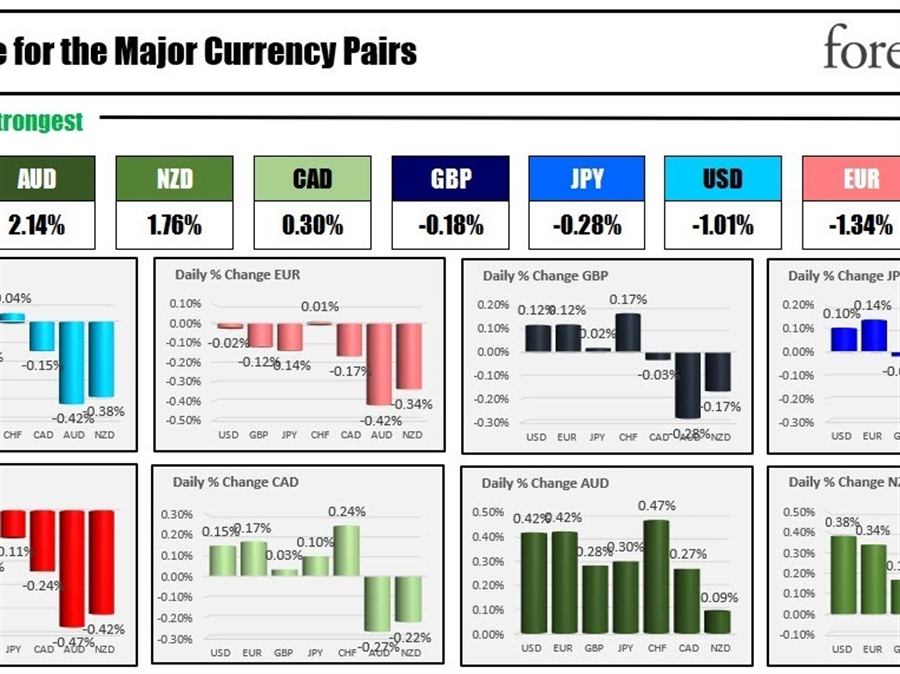

The AUD is the strongest and the CHF is the weakest as the North American session begins. The weekly initial jobless claims, Philly Fed Manufacturing index (remember Empire Manufacturing plunged to -31.3 on Tuesday vs 11.1 the previous week), and Canada producer prices will be released at the bottom of the hour. Existing home sales and Leading index will be released at 10 AM ET. Home sales data is gettting weaker and weaker. The expectations is for a fall in the sales pace to 4.89M vs 5.12M last month (you have to go to June 2020 at 4.72M. It was as high as 6.5 in January. The level before the pandemic was around 5.4M as a guide. The Leading index has been negative for 4 consecutive months foreshadowing lower economic growth.

Russian Pres. Putin said that he could meet with Ukraine president Zelinsky.

ECB’s Schnabel says a recession alone would not be enough to control inflation and that fiscal and structural policies are required to tame the price rises.

A look around the markets are showing:

- Spot gold is trading up $9.08 or 0.52% at $1770.58.

- Spot silver is up $0.14 or 0.73% at $19.90.

- WTI crude oil futures are up $1.09 at $89.22.

- The price bitcoin is trading at $23,532 after trading as low as $23,296 in trading today

In the premarket for US stocks, the major indices are trading higher after yesterdays declines

- Dow industrial average up 75 points after yesterdays -171.69 point decline

- S&P index up 11 points after yesterdays -31.16 point decline

- NASDAQ index up 49 points after yesterdays -164.43 point decline

In the European equity markets, the major indices are trading higher:

- German DAX up 0.72%

- France’s CAC up 0.4%

- UK’s FTSE 100 up 0.1%

- Spain’s Ibex up 0.25%

- Italy’s FTSE MIB up 0.6%

In the US debt market, yields are lower after the FOMC meeting minutes yesterday. Next week is the Jackson Hole Summit. There is chatter that the Fed would have to be more hawkish in order to stave off an overly positive and stimulative market expectations (i.e.lower yields, higher stocks) him.

In the European debt market, yields are mixed