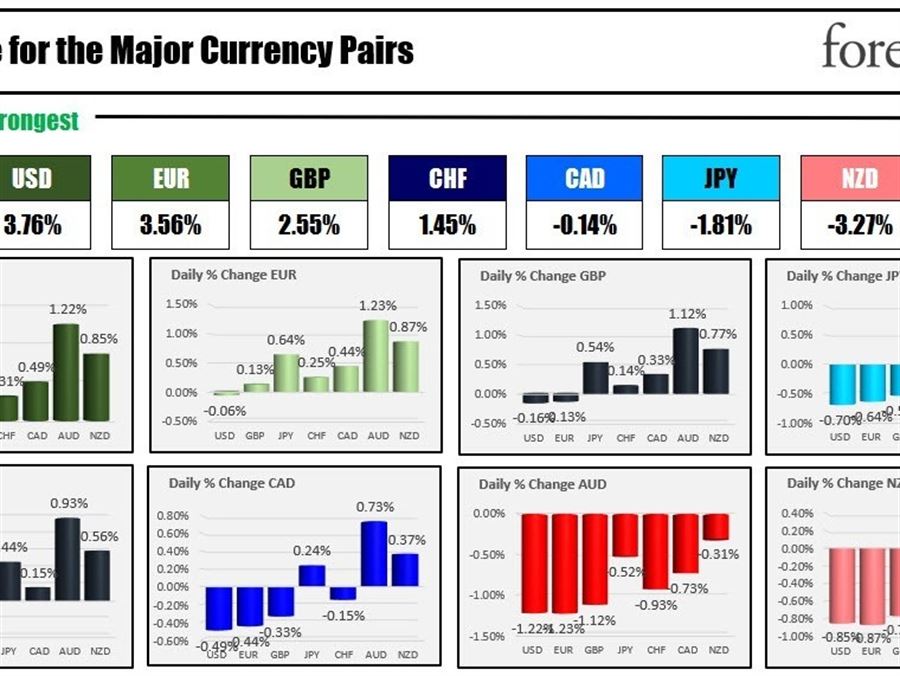

As the North American session begins the USD is the strongest of the majors, the AUD and the NZD are the weakest. The NZD is lower despite a 50 basis point hike by the week Reserve Bank of New Zealand. The high took the rate to 3.0% from 2.5%. The pre-pandemic rate was at 1.00%. The most recent plateau high from 2015 reached 3.5% before rates started to move back down. The rate hike was expected, but the market anticipated the rise. The NZDUSD moved higher but reversed back to the downside in European trading on expectations of a earlier than expected pause.

Softer wage data at of Australia sent their currency lower.

In the UK CPI inflation year on year rose by 10.1% the highest level since 1982. However prices of the GBPUSD reversed lower staying below its 100 and 200 hour moving averages which are converged near 1.2118. European yields remain sharply higher, and stocks are lower as well.

Today retail sales will be released in the US. Retail sales are expected to slow to 0.1% from 1.0%. Traders will be watching the X gas and auto data. Retail sales are not adjusted for inflation and gas prices fell sharply.

Retail giant Target announced results today with a disappointment from the earnings-per-share and revenue but they did say guidance is a still on track.

Business inventories will also be released today along with weekly crude oil inventory. The private data showed a crude oil draw of -0.448M barrels vs -0.275M expectations for for EIA data. Gasoline inventories fell by -4.48M vs expectations of -1.096M. Later this afternoon at 2 PM ET, FOMC meeting minutes will be released. Recall the Fed hiked by 75 basis points taking the rate to 2.5% (top end target)

US stocks are lower. The NASDAQ which was the only index that fell yesterday is leading the way to the downside today. The Dow industrial average rose yesterday but is giving up much of its gains in early trading. Bed Bath and Beyond is up another 24% in premarket trading today as the meme stock continues to be the focus for the meme traders.

In other markets:

- Spot gold is down $6.23 or -0.35% at $1769.64

- spot silver is down $0.26 or -1.31% at $19.85

- crude oil is down $0.63 at $86.48

- the price bitcoin is below the $24,000 level and trades at $23,752. That is near the low for the day at $23,688

In the premarket for US stocks, the major indices are trading lower:

- Dow industrial average -186 points after yesterdays 239.57 point rise

- NASDAQ index -112 points after yesterdays -25.5 point decline

- S&P index -33 points after yesterdays 8.04 point rise

In the European equity markets:

- German DAX -1.05%

- France’s CAC -0.45%

- UK’s FTSE 100 -0.28%

- Spain’s Ibex -0.57%

- Italy’s FTSE MIB, -0.4%

In the US debt market, yields are moving higher ahead of the FOMC meeting minutes:

The European debt market, yields are sharply higher:

European yields remain sharply higher.