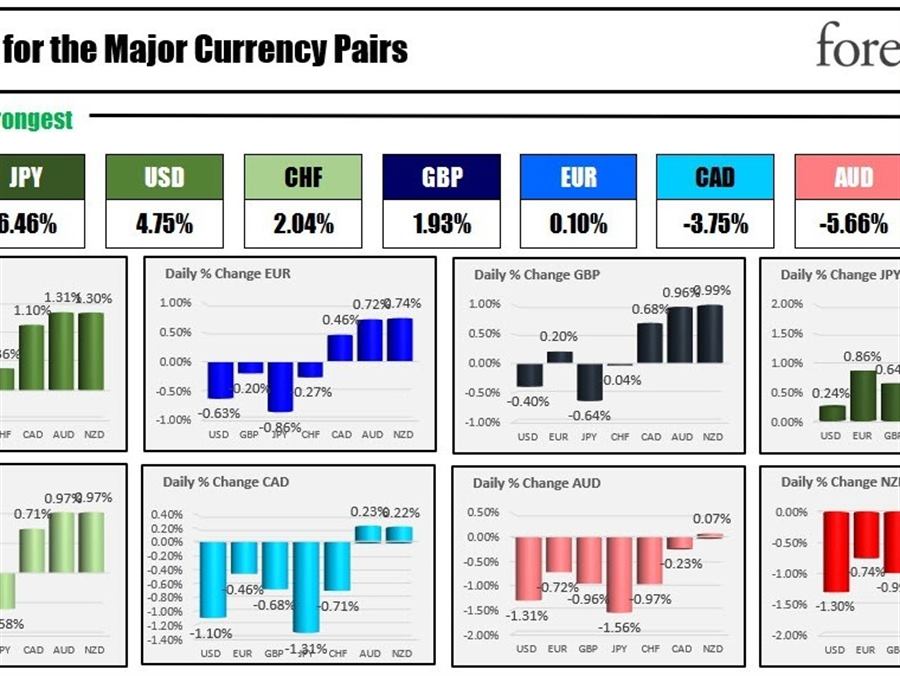

As the North American session begins, the JPY and the USD are the strongest of the major currencies and teh NZD and the AUD are the weakest.

Risk off sentiment is force as the markets react to CHina slowdown last month. A string of data over the weekend (retail sales, industrial production, house prices) came in weaker than expectations. The PBoC cut its 1 year prime rate by 10 basis points in a surprise move. The zero Covid policy and real estate issues continue to weigh on their economy. There were news reports at the end of last week that Apple iPhone sales in China had also fallen sharply.

The EURUSD rallied to its 100 hour moving average in the early Asian session before plunging to the downside, breaking below its 200 hour moving average in the process. The GBPUSD also fell away from its 100/200 hour moving averages in a bearish move. The USDCAD move sharply to the upside as dollar strength and sharply lower oil prices sent the loonie lower (and the USDCAD higher). It ran above its 100 and 200 hour moving averages and 50% of the move down from the August high as well (at 1.2855).

For my preview of the key technical levels in play this week and why, see the video post here.

US and European stock indices are lower. US interest rates are marginally lower. Crude oil is down sharply.

A snapshot of other markets shows:

- spot gold is trading down $-28.52 or -1.58% at $1773.55

- spot silver is trading down $0.64 or -3.07% at $20.14

- WTI crude oil futures are trading down -$4.88 at $87.18. The low is testing the swing low from August 5 at $87 and and $0.03

- the price bitcoin is trading at $24,100 after reaching a high of $25,212 earlier today

In the premarket for US stocks, the major indices are lower after Friday’s sharp gains

- Dow industrial average is down -169 points after Friday’s 424.3 point rise

- S&P is down -23.15 points after Friday’s 72.86 point rise

- NASDAQ index is down 50.37 points after Friday’s 267.27 point rise

In the European equity markets, the major indices are marginally lower:

- German DAX, -0.1%

- France’s CAC, unchanged

- UK’s FTSE 100 -0.34%

- Spain’s Ibex unchanged

- Italy’s FTSE MIB is up 0.4%

In the US debt market,

- 2 year yield 3.222%, -3.1 basis point

- 5 year 2.925%, -2.5 basis points

- 10 year 2.800% -4.0 basis points

- 30 year 3.078% -3.7 basis points

In the European debt market, yields are also moving sharply to the downside as concerns about their economies continue to escalate