The Fed raised rates last Wednesday where the Fed chairs comments were interpretted that the Fed would be more data depedent going forward. The market interpreted the comment to mean if July inflation is lower, it as an open road ahead. Traders started to push yields lower with the 10 year moving to 2.516% (from 3.497% cycle high). The 2 year moved to 2.819% (from a cycle high at 3.454%).

Then the Fedspeak started with each successive member more or less saying the same thing.

- The Fed will continue to move rates higher

- Rates would stay higher for a long period

- Rates will not come down in 2023 like the market has started to price in

- There is no indication that inflation is coming down

- Employment remains strong

They don’t say it, but under their breathe they are also saying “stocks stop going up” and “housing, prices have to come off the boil too”. Their thinking is if the “markets” start to line pockets once again with oversized gains, it is just going to stop the plans of the Fed way too early. That plan is to temper demand. Temper prices/inflation, slow employment growth (and maybe even push it back toward 4%) and get rid of the idle speculation a bit too.

So yields did move back higher yesterday and into today as well. The 2-year moved from 2.81% to 3.198%. The 10 year went from 2.516% to 2.844%, but as I type the 2 year is back down to 3.08% and the 10 year is at 2.716%.

Damn the Fed and Fedspeak. It is full steam ahead.

The US stock market which was already giving the Fed the proverbial middle finger by moving higher at the open, continued to move higher all day long.The 2 day decline seen on August 1 and August 2, saw all the declines erased and then some with the gains today in the broader S&P and the Nasdaq indices.

At the close the final numbers showed:

- Dow industrial average up 416.33 points or 1.29% at 32812.51

- S&P index up 63.98 points or 1.55% or 4155.18

- NASDAQ index up 318.41 points or 2.59% at 12668.17

- Russell 2000 up 26.47 points or 1.47% at 1908.92

In the debt market, although 2 year yield is still up by 2 basis points, it was up 14 basis points at the high. The 10 year is trading down -4.4 basis points after being up 9 basis points, and the 30 year is down -5.9 point basis on the day after being up about 7 basis points at the high him.

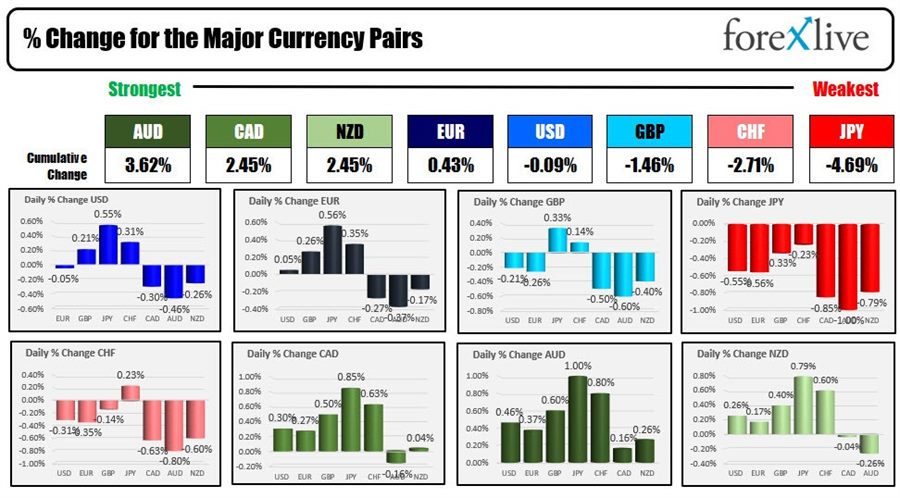

In the forex, the USD ran to the upside in the US morning session but topped out when London traders were getting ready to exit and moved back down in the US afternoon. At the end of the day, the AUD is ending as the strongest of the major currencies, while the JPY is the weakest. The USD is mixed with gains vs the GBP, JPY and CHF and declines vs. the CAD, AUD and NZD. The EURUSD is closing near unchanged.

- The EURUSD moved to a low at 1.0122 which was just above a swing area between 1.01148 and 1.0121 him him. The pair is back at 1.0170 near the close for the day. In the new trading day the 200 hour moving average at 1.0196 and the 100 hour moving average at 1.021 will be eyed as a key upside barometer for the buyers and sellers. The high price today stalled right near the upper 100 hour moving average level.

- The GBPUSD fell below both its 200 hour moving average and rising trend line on the hourly chart which came in near 1.2120. The low price reached 1.2099 before bouncing back higher, moving back above the moving average and trendline, and closing near 1.2145. It would take a move back below the 200 hour moving average to increase the bearish bias in the new trading day (currently at 1.21255)

- The USDJPY rose to a high price of 134.54, which got within 10 pips of the falling 200 hour moving average at 134.64. The price has not traded above the 200 hour moving average since July 21. The momentum stalled and the dollar started to move back to the downside. The pair is closing near 133.895. That’s back below the 50% retracement of the move down from the high price last week (at 133.948)

- The USDCHF moved back above its 100 day moving average at 0.96188 and moved up to test a topside swing area between 0.9652 and 0.9657. Sellers leaned against that area and push the price back below the 100 day moving average into the close. The price is currently trading at 0.9603. Getting back above the 100 day moving average at 0.96188 will be required in the new trading day to give the buyers more confidence once again.

- The USDCAD bottomed in the early US session near its 100 hour moving average currently at 1.2833. The subsequent spike to the upside saw the pair peak at 1.2884, before rotating straight back to the downside and back to the 100 hour moving average once again at 1.2833. The current prices trading at 1.2836 going into the close.

IN other markets heading into the close for the day:

- Spot gold is up $4.60 or 0.26% $1764.66

- Spot silver is up $0.11 or 0.58% at $20.05

- Bitcoin is trading steady at $23,340

- The price of WTI crude oil is trading at $90.88 that’s down $3.58 or -3.79% on the day. The price is closing at the lowest level since February 2022