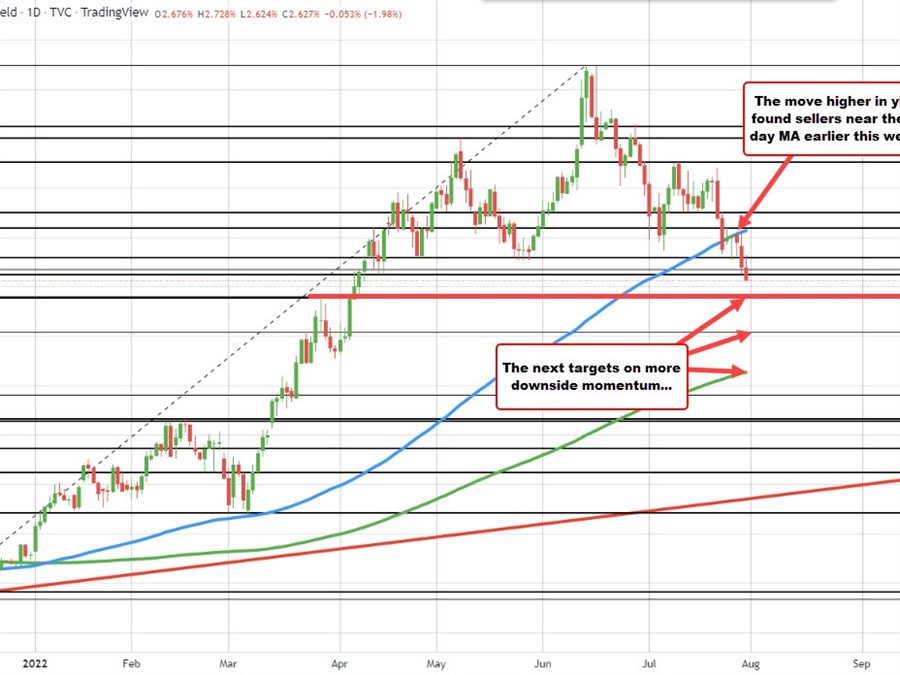

The US 10 year yields are trading at session lows of 2.624%. The high yield for the day reached 2.728%. The yield has moved below swing lows from April 13 and April 14 at 2.648% and trades at the lowest level since April 7.

The next target comes against the swing high from March 28 and the swing low from April 7 at the 2.557%. Below that, and the 50% midpoint of the move up from the December 3 low cuts across at 2.417%.

Last week the price moved below the 100 day moving average (blue line in the chart above). On Tuesday, Wednesday, and Thursday this week sellers leaned against that moving average and broke lower yesterday.

Last week, the yield closed at 2.752%. Since July 21 (7 trading days), the yield has moved from a high of 3.081% to the low today of 2.624% (-46 basis points). The high yield for the year reached 3.497% back in mid-June . The yield is down 88 pips from that high.