UPCOMING

EVENTS:

Tuesday: US

CB Consumer Confidence.

Wednesday:

FOMC Policy Announcement.

Thursday: US

Q2 Advance GDP.

Friday: US

PCE.

We closed

the last week with surprisingly awful US PMI data. The services index in

particular fell much lower than expectations to 47 from the prior 52.7 a month

earlier. That is a very fast deterioration and at a rate not seen since 2009

amid the global financial crisis. Generally, it’s the Manufacturing sector that

falls faster as it’s more cyclical than the Services sector even if it accounts

for just 20% of consumption. The Services sector though accounts for a huge

80%, which highlights even more how awfully the economy is performing.

The US

economy may already be in recession and we may get a confirmation of that on

Thursday when we will get the US Q2 Advance GDP report, which according to the

Atlanta Fed GDPNow model, is likely to show another negative print.

Technically, two consecutive quarters of negative GDP is considered a

recession.

Having

considered all of this, the market is likely to return to a risk off sentiment

this week. There’s a common thought that bad news now is good news as the Fed

is more likely to pause or even start cutting interest rates as the recession

will bring inflation down. That absolutely makes sense and in recent recessions

worked well, but the problem this time is that inflation is much higher and

broader. I think the Fed will want to see clear evidence of inflation getting

back to target before signalling a pause or the start of a cutting cycle. This,

of course, will make the recession even worse and translate into more risk

aversion in the market.

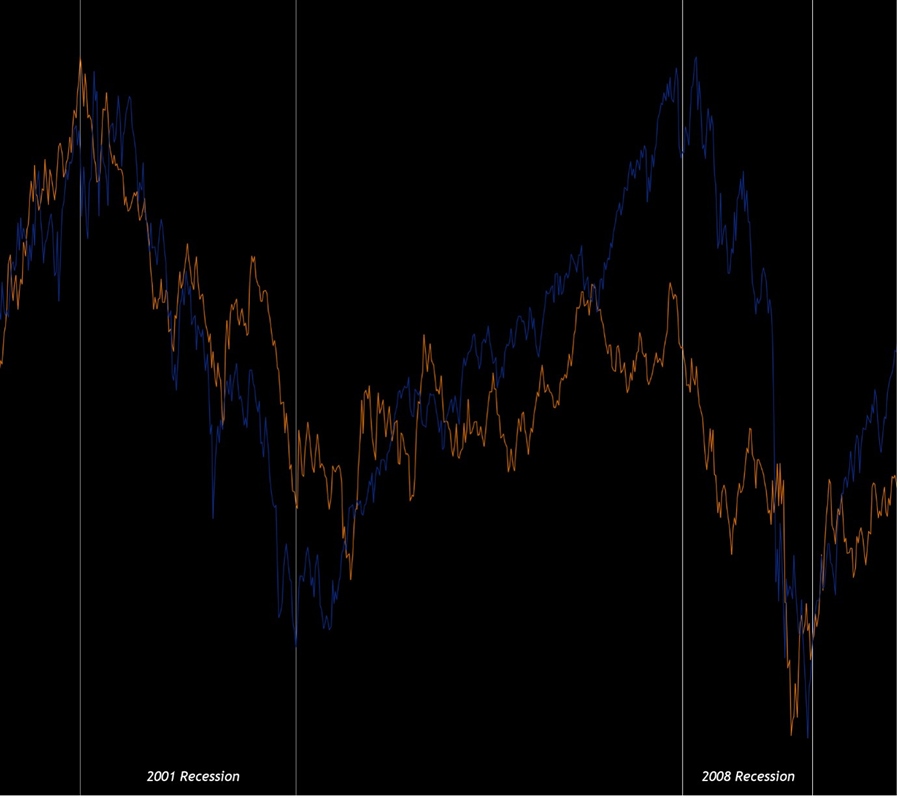

Some also

say that falling yields are good for the stock market but do not consider the

context. Yields in this case will fall as the market will see such a bad

contraction that the Fed will pivot earlier than expected. The stock market in

such cases falls together with yields as the economy worsens badly. Below you

can see a chart of the two recent notable recessions.

S&P500 (Blue Line)

vs. US10Y (Orange Line)

To sum up, I

think this week will mark the end of the relief rally we saw the last week

after Fed’s Waller comments and the lower than expected long-term inflation

expectations in the UMich survey.

On Tuesday

we get the US Conference Board Consumer Confidence report which is expected to

deteriorate further.

On Wednesday

we will have the main event of this week, the FOMC Policy Announcement. After

an initial pricing of a 100 bps hike after the hot CPI report, the market

quickly switched back to expecting a 75 bps hike as comments from the two most

hawkish Fed members, Waller and Bullard, signalled a more conservative approach

and economic data like the long-term inflation expectations in UMich survey,

the housing data and PMIs further cemented the expectations of a 75 bps hike at

this meeting.

Given that

the Fed now is more focused on inflation than growth and that the next FOMC

meeting is two months away, there’s still a little chance that they go for 100

bps and see what the next two inflation reports will show before the September

meeting. They may think that the risk of hiking less and get two hot inflation

reports after, may be greater than going for 100 and then see an easing in

inflation. On the other hand, the Fed generally follows market expectations

because it doesn’t like to surprise, so a 75 bps is comfortably the base case.

Markets are

currently pricing in a year-end Fed Funds rate at 3.25-3.50%, which is also the

market-implied terminal rate with rate cuts priced in Q1 2023.

On Thursday

we will get the above-mentioned US Q2 Advance GDP report, which is expected at

a positive 0.5% annualised rate. The Atlanta Fed GDPNow model points to a

negative 1.6% estimate.

On Friday we

will see the Fed’s preferred measure of inflation, the Core PCE. The M/M rate

is seen rising 0.5% compared to the previous 0.3%, while the Y/Y figure is

expected at 4.7%, the same as the prior reading. We will also get the US ECI

(Employment Cost Index) which Powell has previously said it’s a key metric he

watches. The ECI is seen falling to 1.2% from the prior 1.4% and a higher

number would be unwelcomed for the Fed as it will increase their concerns

around a second-round inflation effects.

This article

was written by Giuseppe Dellamotta.