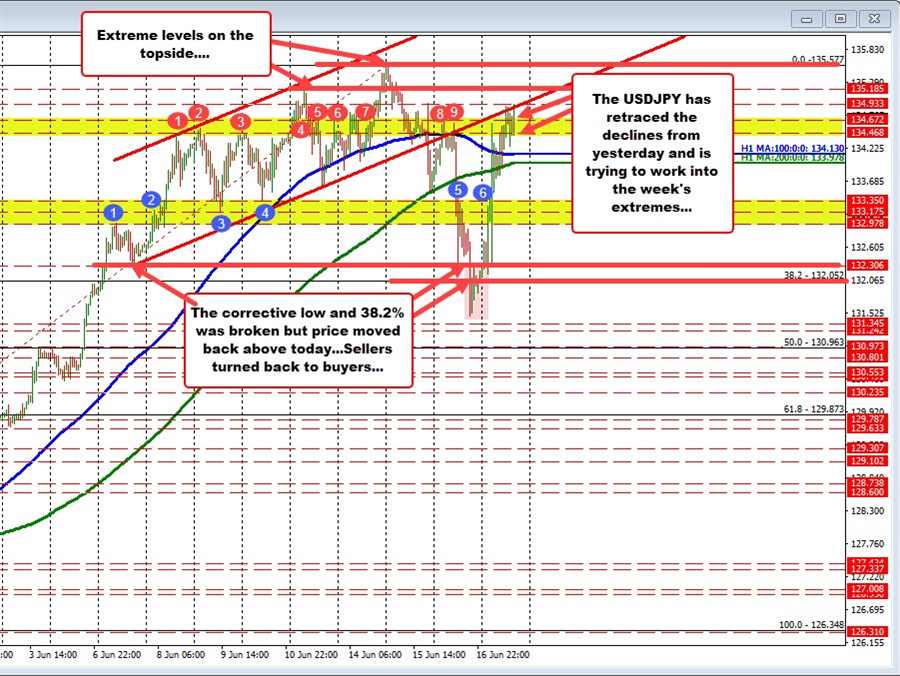

The USDJPY moved sharply lower yesterday, helped by a crack below the 200 hour MA (green line), a move below a swing area between 132.97 and 133.35, and a corrective swing low at 132.30. Finally the pair also fell below the 38.2% retracement of the move up from the May 24 low at132.05. The steps to the downside targets gave traders comfort and confidence to push lower (the dollar selling bias on weak US data was also a catalyst).

However, in trading today, the USDJPY moved back above the 38.2% and the swing level at 132.30 giving the pair a boost. The next target at the swing area up to 133.35 was tested and backed off, but was broken later, and sellers turned back to buyers.

Helping fundamentally was the BOJ keeping rates steady and Kuroda saying that it is all systems go for bond yield targeting and bond buying.

The price has now moved above the 200 and 100 hour MA between 133.99 and 134.136.

Currently the pair is moving above another swing area between 134.468 and 134.672 and as I type is breaking above 135.00 too.

What now?

Overall, the pair has completed the down and back up “lap” started yesterday and has entered in the upper “extreme” area for the week. The swing high from Monday at 135.18 and the high from Wednesday at 135.577 would be other targets in that extreme area to get to and through.

A move above the 135.577 would take the pair to the highest level since October 1998.

Watch the 134.93 as real close intraday support now. Stay above and the push the upside can continue with confidence. Below that a move back below 134.672 would probably not be the best for buyers looking for more upside from a technical perspective..