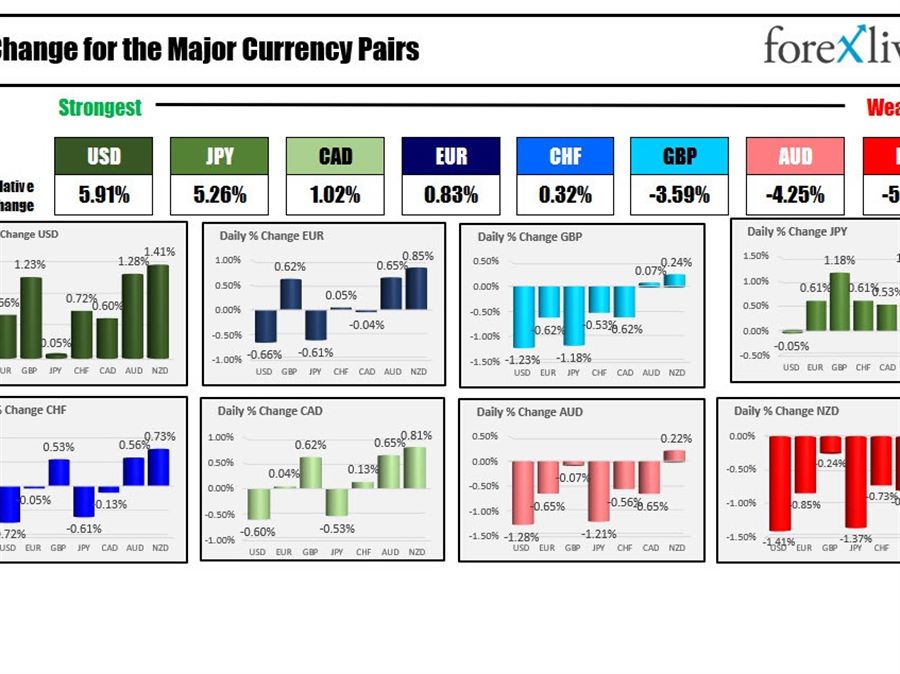

The USD is the strongest and the NZD is the weakest as the markets are in turmoil. Flight to safety flows are in play with the JPY also up strongly. The AUD is following the NZD.

The S&P is set to open in bear marker territory (down over 20%) as stocks take another large step to the downside in premarket trading. The Nasdaq is down some 30% from it’s high (at premarket levels).

Yields are higher after the stronger than expected US CPI on Friday. The yields are up double digits in the US to start the week. Meanwhile Italian 10 year yields are up nearly 17 basis points as yield spreads continue to widen in Europe (German 10 year is up 10.6 basis points).

Bitcoin plunged over the weekend as Celcius – one of the largest crypto lending operations – abruptly halted customer withdrawals. Bitcoin is down -13.86% today and traded as low as $23424. As a reminder, the digital currency was above and below the $30000 level on Friday.

The Fed and the Bank of England are likely to raise rates this week into the high inflation environment while markets sink and household wealth tumbles. Gas is over $5 but oil is lower today.

China is testing nearly all of Shanghai as they continue to fight the pandemic. The implications will reverberate around the glove

A snapshot of the markets are showing:

- Spot gold is trading down $-20.30 or -1.10% $1850

- Spot silver is trading down -$0.25 or -1.15% of $21.62

- WTI crude oil is trading down -$1.84 of $118.81

- bitcoin is trading at $24,153 after closing Friday just below the $30,000 level (see Celsius report above). The low price for bitcoin reached $23,424.42

In the premarket for US stocks, the futures markets are implying a sharply lower opening after Friday’s sharp declines

- Dow is trading down -493 points after Friday’s -880 point decline

- S&P index is down -80 points after Friday’s 116.96 point decline

- NASDAQ index is down -307 points after Friday’s -414.20 point decline

In Europe, the major indices are sharply lower

- German DAX is down -263.22 points or -1.91% at 13497.13

- France’s CAC down -126.58 points or -2.05% at 6060.66

- UK’s FTSE 100 is down -89.35 points or -1.22% at 7228

- Spain’s Ibex is down -154 points or -1.84% 88236.89

- Italy’s FTSE MIB down -503 points or -2.23% to 20244

In the US debt market, the yields are modestly changed with the shorter end higher in the longer end lower:

- 2 year 3.17%, up 12.1 basis points

- 5 year 3.379%, +12.5 basis points

- 10 year 3.2572% +10 basis points

- 30 year 3.279%, up 8.3 basis points

In the European debt market, benchmark 10 year yields are all sharply higher with Italian and Spain yields leading the way to the upside: