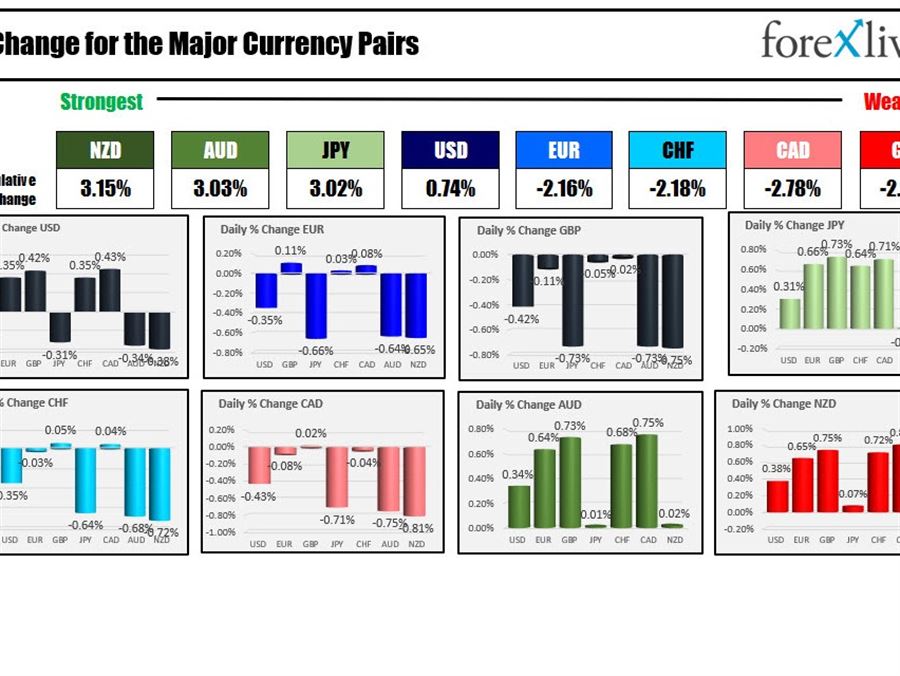

The NZD (and AUD) is the strongest of the majors while the GBP (and CAD) is the weakest as North American session begins.

The US CPI will be the highlight at 8:30 AM with the expectations are for the headline number to rise by 0.7%. The core measure is expected to rise by 0.5%. The headline YoY is expected to come in at 8.3%, unchanged from last month. The core is expected to decline to 5.9% from 6.2%. Canada will also release their employment statistics with the employment change expected at 30K vs. 15.3K. The unemployment rate is expected to remain steady at 5.2%.

The day after ECB Pres. Lagarde paved the way for the rate launch in July – the 1st tightening in 11 years -but also raised concerns of the maneuvering and risks as a result of the disparity in interest rates. The Italian vs. German 10 year yield spread spiked to 232 basis points from 136 basis points at the end of the year. The Italian 10 year yield traded as high as 3.78% today up from 1.185% at the end of the year. That is the highest rate since October 22, 2018. In 2018 the high yield peaked at 3.891%. Move above that level would take the yield to the highest level since 2014.

US stocks are mixed with the Dow down marginally while the NASDAQ up marginally. US yields are up in the shorter end with the 30 year down about 1 basis point. The 30 year auction went very well yesterday after the 3 and 10 year auctions were met with tepid international demand on Tuesday and Wednesday.

Crude oil prices are back higher and trading near $122.50. Natural gas is moving lower in early North American trading and back below $9 to $8.81 after reaching $9.15 earlier.

A snapshot of the markets are showing:

- Spot gold is trading down $-14.87 or -0.81% at $1832.65

- Spot silver is trading down $-0.35 or -1.67% $21.32

- WTI crude oil is trading up up $0.96 or 0.79% at $122.47

- bitcoin is trading at $30,009. The low price reached $29,550 while the high price extended to $30,333

In the premarket for US stocks, the futures markets are implying a mixed opening

- Dow is trading up down -17.79 points after yesterdays -638.11 point decline

- S&P index is up 2.5 points after yesterdays -97.97 point decline

- NASDAQ index is up 43 points after yesterdays -332.05 point decline

In Europe, the major indices are sharply lower for the 2nd consecutive day concerns about slower growth due to higher inflation

- German DAX is down -157 points or -1.11% 14041.59

- France’s CAC down down 87 or -1.37% at 6271.64

- UK’s FTSE 100 is down 90.95 points or -1.22% 7385.38

- Spain’s Ibex is down down 204 points or -2.35% 8506.91

- Italy’s FTSE MIB down 917 points or -3.85% at 22860

In the US debt market, the yields are modestly changed with the shorter end higher in the longer end lower:

- 2 year 2.855%, +3.98 points basis points

- 5 year 3.082%, +1.8 basis points

- 10 year 3.043%, +0.2 basis points

- 30 year 3.161%, unchanged

In the European debt market, benchmark 10 year yields are mixed:

.