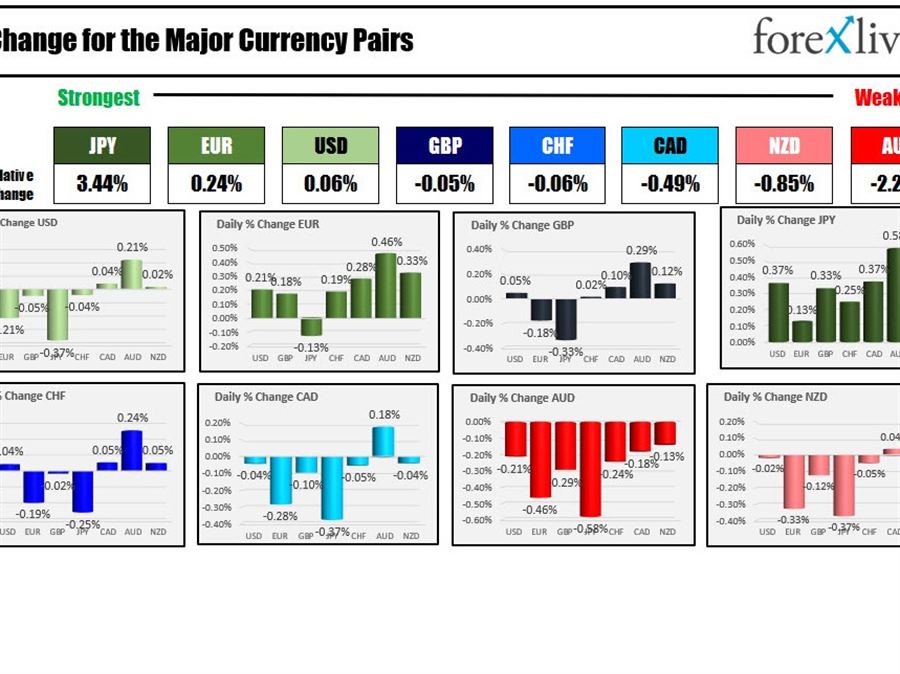

The JPY is the strongest and the AUD is the weakest as the North American traders enter for the day. The JPY’s rise is in contrast to yesterday when it was the runaway weakest reaching the lowest level since February 2002 and getting within shouting distance of the 2002 high at 135.16. The high price yesterday reached 134.557.

The ECB kept rates unchanged as expected. The asset purchases program will end at the end of the month and that will usher into an expected rate hike of 25 basis points next month and going forward. They now see end of year inflation at 6.8% and 2023 at 3.5% well above the 2% target. The market is continuing to price in a 135 basis points of increases by the end of the year. Market traders will be focused on the press conference to begin at 8:30 AM ET and how Lagarde maneuvers through ultralow rates, high inflation, and economic slowdown as result of the Ukraine war (and high energy prices). Also at 8:30 AM, the weekly initial jobless claims will be released with expectations of 205K vs. 200K.

US stocks are higher in premarket trading, after yesterdays declines. The price of crude oil is trading marginally lower but near recent highs and above $120. Natural gas is in flux after a fire at a LNG export terminal in Texas which will likely take out supply for potentially months to Europe. Natural gas futures in the UK and continental Europe, a beneficiary of this plant’s supply, soared over 30% from Wednesday’s close. Meanwhile in the US, prices of natural gas move lower as the suspension in the exports will have the impact of keeping gas in the North American market. Natural gas futures in the US are trading at $8.24 after reaching a high yesterday of $9.65.

A snapshot of the markets are showing:

- Spot gold is trading down $3.84 -0.21% $1848.35

- Spot silver is trading down $0.10 or -0.43% $21.93

- WTI crude oil is trading down $0.20 and $21.90

- bitcoin is trading at $30,361 after trading at $30,248 near the 5 PM New York traders exit yesterday

In the premarket for US stocks, the futures markets are implying a higher opening

- Dow is trading up 125 points after yesterday’s -269.24 point decline

- S&P index is up 19 points after yesterday’s -44.89 point decline

- NASDAQ index is up 69 points after yesterdays -88.96 point decline

In Europe, the major indices are lower as higher energy prices way on the stock markets

- German DAX is down -85 points or -0.59% at 14361

- France’s CAC down -15.7 points or -0.24% 6432

- UK’s FTSE 100 is down -37.5 points or -0.49% up 7555.21

- Spain’s Ibex is down down 44 points or -0.50% at 8798.21

- Italy’s FTSE MIB down down 113 points or -0.46% at 24131

In the US debt market, the yields are modestly changed with the longer end a little lower ahead of the 30 year bond auction at 1 PM ET

In the European debt market, benchmark 10 year yields are mixed as traders adjust to the ECB decision.