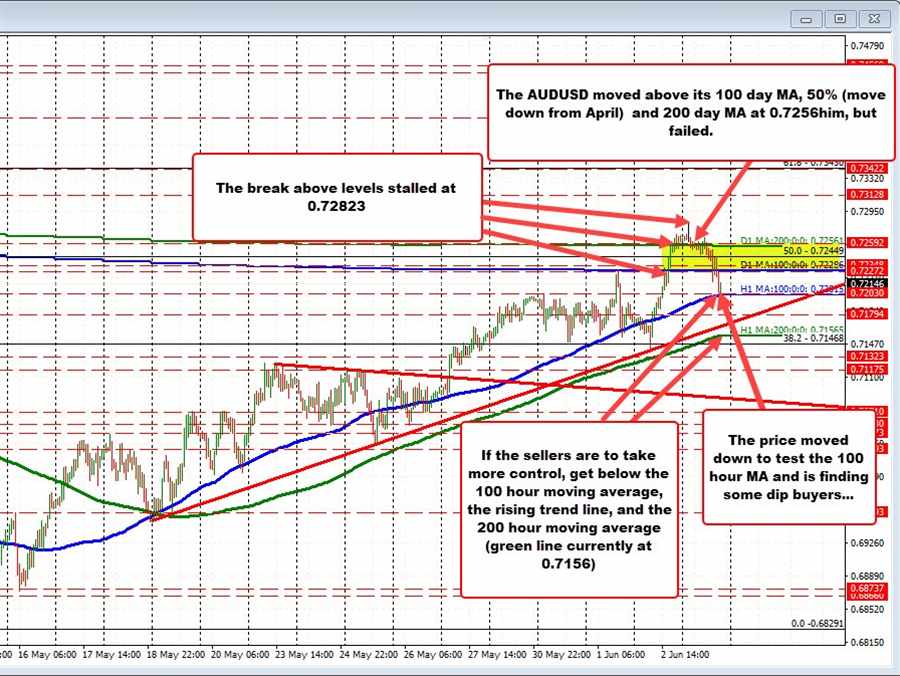

The AUDUSD yesterday first tested – and then broke – above its 100 day moving average at 0.72296 (top blue line on the chart above). The momentum took the price up to the 200 day moving average at 0.72561 (top green line) and ultimately above that moving average level by the close.

In the Asian session today, the price continued its moved to the upside reaching a high for the day at 0.72823 before wandering back to the downside and back below the 100 day moving average at 0.72286.

In the late European morning session/early US session, the price started to see more downside momentum which was helped by the stronger than expected NFP data.

The price decline after the jobs report did bounce higher after the initial reaction, but stayed below the 50% midpoint of the move down from the April high. That midpoint level comes in at 0.72449. Holding below gives sellers incentive to push lower into the end of week.

What now?.

The AUDUSD price has just moved down to test its 100 hour moving average at 0.72015. The low price just reached 0.72011 and bounced modestly. The price is currently trading at 0.72124.

The 100 hour moving average is the next lowest target that sellers would have to get to and through in order to increase the bearish bias. Below that and traders will will look toward the rising trend line at 0.7164 (and moving higher) followed by the 200 hour moving average at 0.71565 (green line in the chart above).

Those would be the progressively more bearish steps.

If buyers return, they would need to get back above the 100 day moving average at 0.72286 and then restart the progression through the 50% midpoint and the 200 day moving average.

The Reserve Bank of Australia will announce their interest rate decision on Tuesday, June 7 at 430 GMT. The most recent Reuters poll has 22 of 35 analysts looking for a 25 basis point hike,11 look for a 40 basis point hike and one is looking for a 50 basis point . There is one that sees no change in policy.

Does not keep the AUD bid?

Maybe, but if the Fed policy gets increasingly bearish again, 50 basis point rises > than 25 or 40 basis point hikes. Watch the levels for clues.