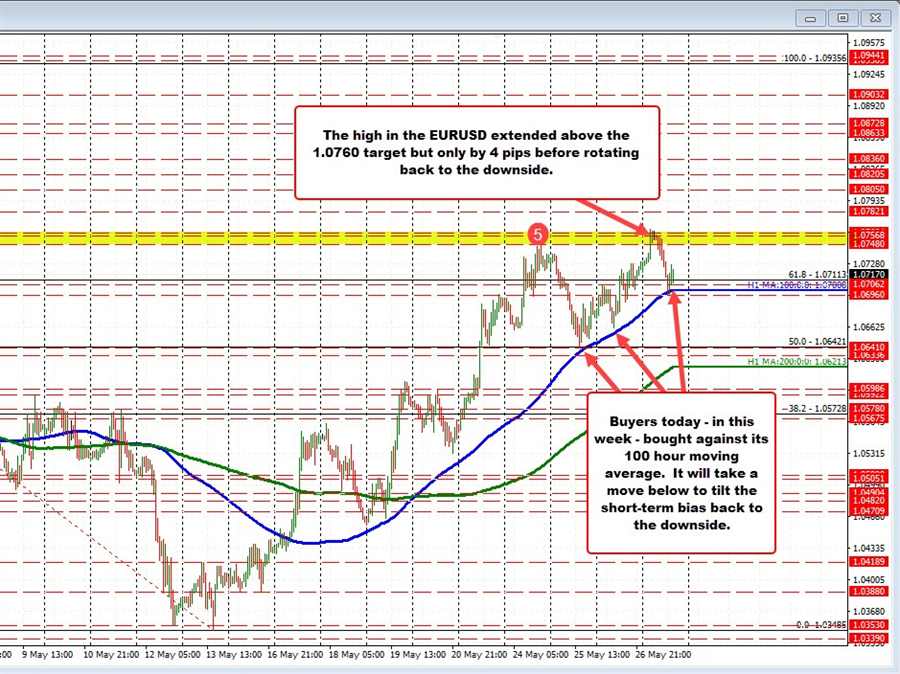

The EURUSD this week found early buyers against its 100 hour moving average on Wednesday, and again yesterday. In trading today, the dip lower after reaching new highs going back to April 25 once again saw the 100 hour moving average stalled the fall.

The 100 hour moving average is currently at 1.0700 the low price reached 1.0696. The 100 hour moving average was at 1.0698 at the time of the dip a few hours ago.

The 100 hour moving averages a key barometer for bulls and bears going forward at least in the short-term. Stay above is more bullish, move below is more bearish.

On the topside, I was looking for the 1.07568 to 1.0760 area as the next upside target (see post from yesterday). That area corresponded with swing lows going back to April 14, and April 19 and a swing high on April 25 (after it broke below that floor level on that day – see red numbered circles).

The high price today in the Asian session reached up to 1.0764 – just 4 pips above that target. The trading momentum stalled, and the price started to rotate to the downside in the European session.

For the week, the price last Friday closed at 1.0550. The high price at 1.0764. That took the price up 214 pips for the 5 trading days (2.0%). The catalyst was a shift of sentiment that the ECB was solidifying the tightening schedule going forward. It won’t start until the APP (Asset purchase program) ends at the end of June. The expectations are that the ECB will start taking way stimulus in July with a 25 basis point hike.