Money markets now expect a 115 bps worth of tightening by the ECB by year-end, with 40% odds of a 50 bps rate hike in July. That is seen up from the 110 bps priced in at the end of last week.

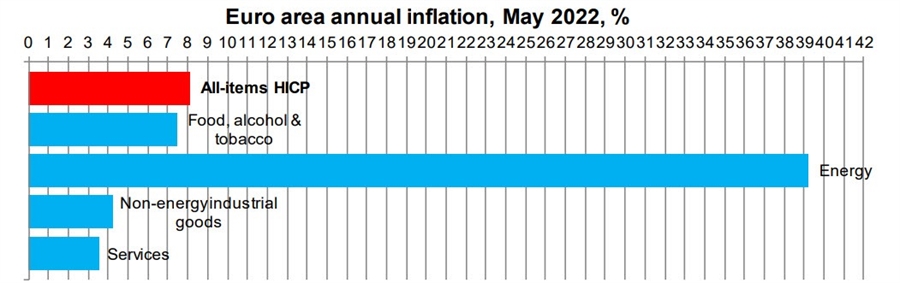

However, with headline inflation crossing 8%, it isn’t just so much a story of energy prices surging already. The jump in price pressures is evident across all areas:

The question now is, can the ECB still stick to the script and only hike rates after ending asset purchases in July?

If this is their queue to act, then why not next week then? I mean considering all the communication as of late, the imminent rate hike feels like semantics at this point. There’s going to be a lot of built-up pressure in the background surely as to the discussions for why they should wait until July before acting.

As such, just be wary that we might get some murmurs about how those discussions are going and that could set up a more nervous backdrop to next week’s meeting. It may not yet be a ‘live’ one based on what policymakers have told us, but let’s see what the ECB message after today will be to make sure.