The USDCHF moved sharply lower on Monday and lower again on Tuesday. Wednesday and Thursday saw choppy action but stayed above the Tuesday low.

Today, the price action has been up and down, but the price of the USDCHF did extend to a new week low and also traded at the lowest level since April 21.

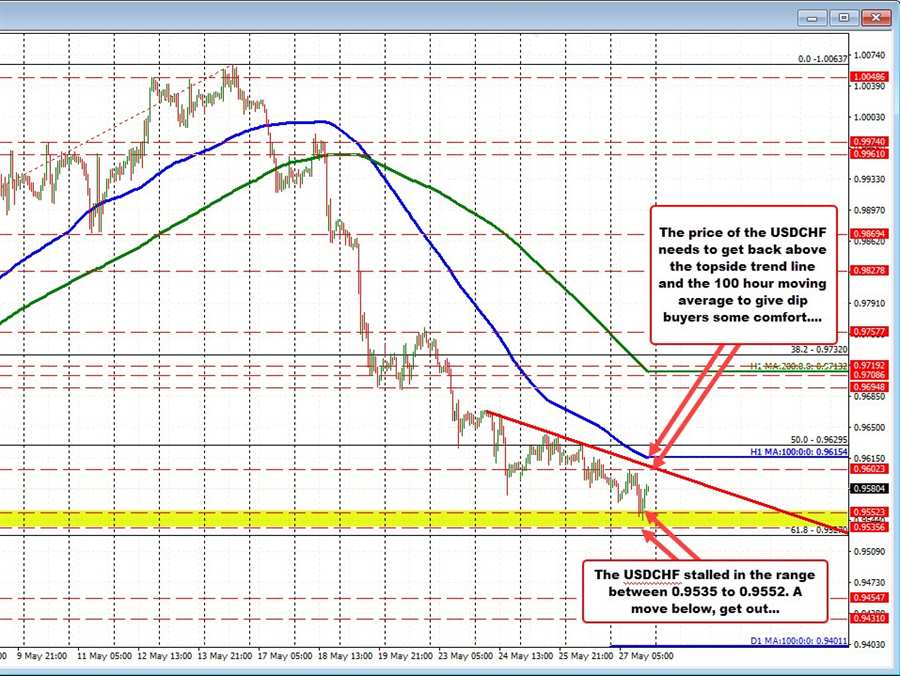

Looking at the hourly chart, the low price down at 0.95442 today stalled within a swing area going back to April 20 through April 25 between 0.9535 and 0.9552 (see red numbered circles and yellow area in the chart above). The price on April 25 returned into that swing area before quickly rotating back to the upside and restarting the trend move higher but ultimately took the price to the cycle high at 1.00637 reached on May 16. Since then the price has been down 8 of 10 trading days culminating in the new low reached today.

Technically since May 17, the price has been able to stay below the falling 100 hour moving average (blue line). The slowing downward trajectory this week has allowed for the 100 hour moving average to catch up to the price. The moving average is currently is at 0.96154. A downward sloping trendline on the hourly chart cuts across just ahead of that at 0.9605.

If the buyers are to take back more control, getting back above the trend line and the falling 100 hour moving average would be needed to give them a short-term victory in what has been a trend like move to the downside since the breaking of the 100 hour moving average on May 17.

Taking a broader look by looking at the 4 hour chart below, the price action this week has taken the price below the 50% retracement of the move up from the March 31 low. That level comes in at 0.96295.

Recall that move to the upside (from the March 31 low), took the USDCHF up 868 pips in 32 trading days. The fall back down has now taken the price 521 pips lower in 10 trading days.

What was the strong and fast move to the upside, has been followed by a stronger and faster move to the downside.

That over sold condition may give the dip buyers against the swing area a reason to stick a toe in the water against the area. Stay above the swing area and the buyers are content. Move above the trend line and the 100 hour moving average at 0.96147 and there is more comfort. Move above the 50% at 0.96295 and there is even more comfort. Absent that however, and the sellers are still in control. Don’t forget that.

I never do this but the RSI on the hourly chart has been diverging for a while now. A word of warning, however, is as the RSI has been diverging this week, lower lows have been made on a number of occasions with limited upside moves. In other words, the market has continued to trend lower.

Trends and fast direction tend to go further than traders expect that can be dangerous for traders using oscillators to try and pick bottoms.

As a result, I always define the risk against a hard level like the aforementioned swing level (it could be a trendline or a moving average or retracement level too). Those levels define risk and limit risk without relying on an oscillator that could continue to diverge in a trending market without a significant retracement.