It was Friday the 13th but the day was not a scary one for the markets. After sharp declines in the US stocks, bond yields and crypto coming into the day, today saw stocks rebound, yields moved back higher and bitcoin even rallied.

Fundamentally, however, there was a scare as the UMichigan preliminary consumer sentiment tumbled to 59.1 vs 64.0 estimate. That was the lowest level in 10 years.

Looking at the components they 2 showed weakness with current conditions in the expectations both falling sharply and inflation expectations remaining steady at high levels:

- Current conditions 63.6 vs 70.5 expected

- Expectations 56.3 vs 63.0 expected

- 1-year inflation expectations 5.4% vs 5.4% prior

- 5-10 year inflation expectations 3.0% vs 3.0% prior

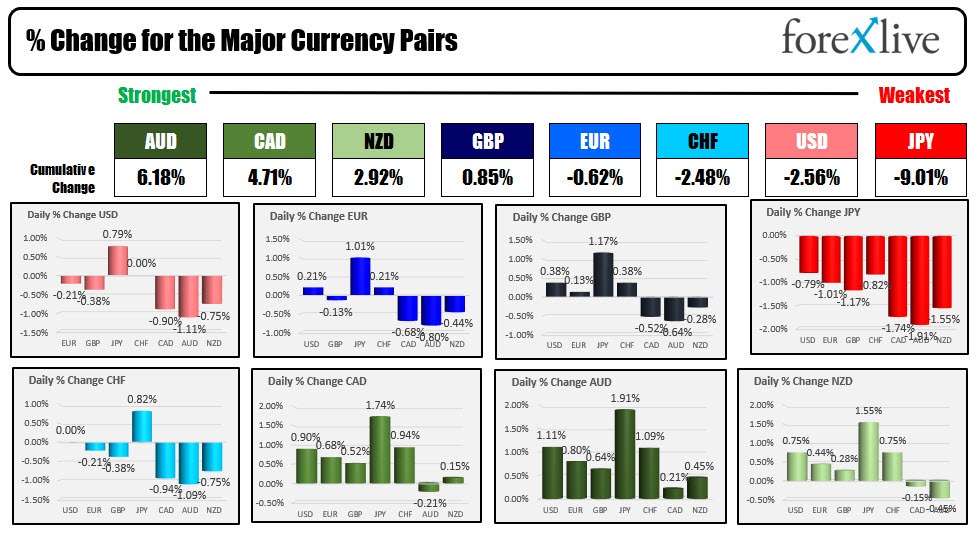

In the forex market today, the USD retraced some of the gains seen of late. The greenback moved lower vs. all the major currencies with the exception of the JPY.

The AUD, CAD and NZD were the strongest of the majors as risk on sentiment increased. The JPY – which traded to yet another 20 year high on Monday before reversing to the downside on Tuesday to Thursday, rebounded back higher today on the increased risk tone and exit out of the relative safety of the JPY .

In other markets:

- Spot gold fell another $10.89 -0.61% at $1811.72. The low price today did below the $1800 level for the 1st time since February 4. Last Friday, the price closed at $1882.99. The decline rate presents a 3.82% the fall for the current week.

- Silver rebounded today after the short fall this week. the spot level rose $0.41 or 2.06% $21.07. That compares to a close a week ago at $22.33. The $1.26 decline represents a -5.6% fall for the week.

- WTI crude oil futures are trading at $110.13 near the 5 PM level. That’s up around $4.03 on the day. The settlement price for the week was at $110.49

.

In the US stock market, the sentiment was more positive today after the S&P index got within a whisker of -20% from the all-time high during yesterday’s trade (at the low for the week, they S&P was down -19.92%).

The gains today were led by the NASDAQ index which rose 3.82%. The NASDAQ index has been hit the hardest in the move down in 2022 with the index reaching a low of –31.48% from the all-time high at session lows yesterday. The broader NASDAQ and S&P index were still lower for the 6th consecutive week, while the Dow industrial average fell for the 7th consecutive week.

In trading today, the major indices all gapped higher and did not trade lower on the day which was a breath of fresh air.

In the US debt market, after declines from Monday’s highs into today’s trading, the yields along the yield curve saw a rebound back to the upside.

Fed members this week continued to stress that rates would go higher until they reached a more neutral level around 2.5%. With the current yield at 1.0%, that leaves room for at least another 150 basis points.

Most expressed the desire to raise ratees by 50 basis points the next 2 meetings. After that there is some debate.

Fed’s Bullard, the most hawkish of members, said this week that he would like to see to the Fed to tighten to 3.5% by the end of the year. Others are more in the 2.5% camp but would be willing to increase the rates if warranted.

This week, the CPI data showed a higher than expected increase (although the rate was lower from the previous month). With crude oil prices higher and gasoline price also moving higher ahead of the Memorial Day holiday, the hopes for relief from lower oil prices does not seem encouraging. That could lead to a more tight Fed, but could also lead to slower growth at the same time.

Hope you all have a good weekend. Thank you for your support.