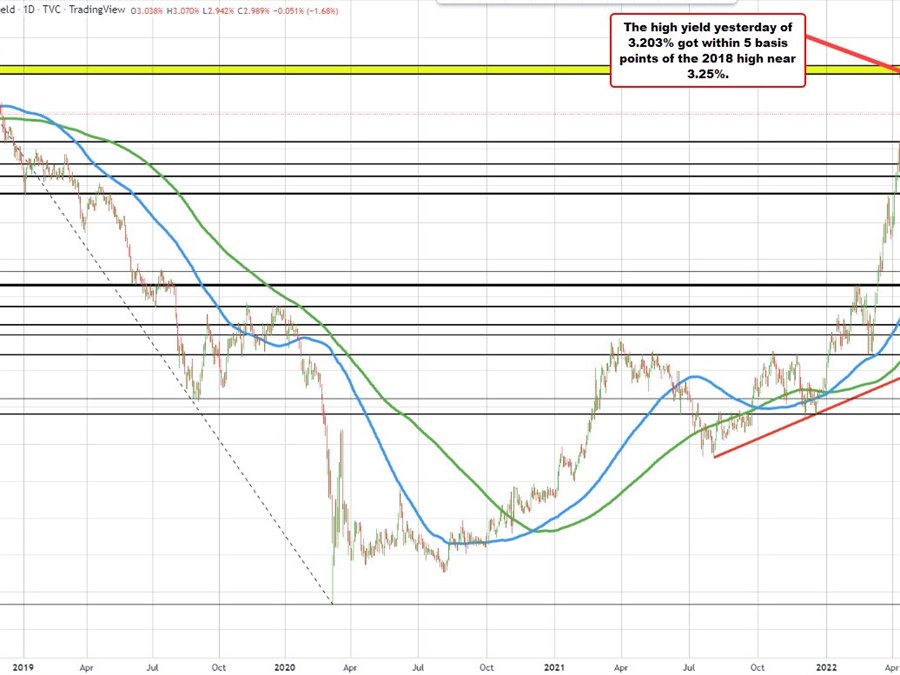

Yesterday the 10 year yield reached a high yield of 3.203% yesterday before starting a rotation back to the downside. The high yield going back to 2018 came in at 3.25% (see red numbered circles in the chart above). The high yield got within 5 basis points of that level before rotating back to the downside.

Drilling to the hourly chart below, the fall from the high yield yesterday has seen the yield move back below its 100 hour moving average at 3.042% in trading today. The momentum took the price down to the 200 hour moving average of 2.951%. The low yield for the day reached just below that level at 2.942% before bouncing back higher. The current yield is at 2.993%. Support held against the 200 hour moving average..

Off of the hourly chart, the technical bias is neutral between the 100 hour moving average above and the 200 hour moving average below.

On the downside, the 50% midpoint of the move up from the May April 27 low is also near the 200 hour moving average at 2.952%. That increases the levels of importance. Going forward, a move below both those levels would likely lead to a further deterioration in the yield.

Conversely, moving above the 100 hour moving average at 3.042% would be a signal that the yields are back on an upside trajectory.

Much will depend upon the CPI data scheduled to be released at 830 tomorrow. The urine year inflation is expected to dip to a .1% from 8.5% last month. The core/ex food and energy is expected to fall to 6.0% from 6.5%.