Bank of America Global Research discusses its expectations for tomorrow’s FOMC policy meeting.

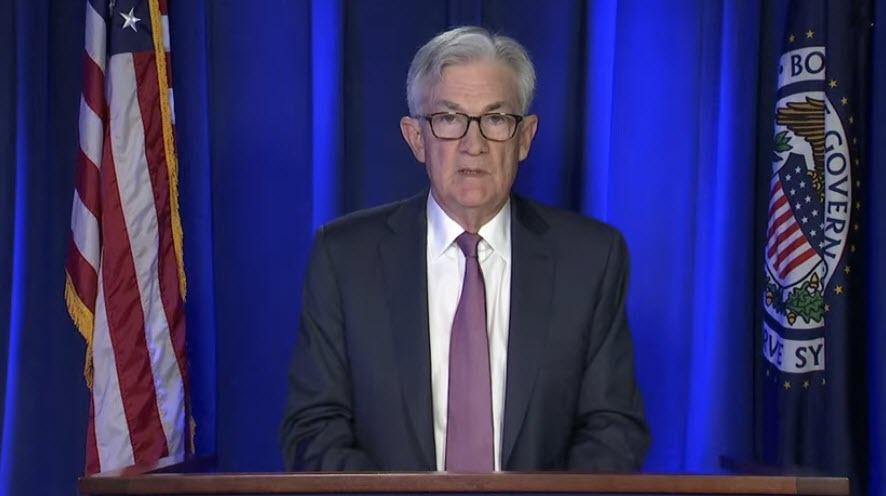

“We expect a hawkish May FOMC meeting with the Fed delivering a bigger 50bp rate hike and announcing QT, starting in June…Chair

Powell will likely reiterate the need to hike “expeditiously” &

restore price stability to prolong the business cycle…It will be hard for Fed to out-hawk the market. A non-committal Powell on 75bp June hike risks slightly dovish market outcome,” BofA notes.

“In our view, the FX market has already priced in a hawkish 50bp hike and announcement of QT at this week‘s Fed meeting, so we see a high hurdle for the US dollar to advance on the day

narrowly on account of Fed-related monetary policy factors, unless of

course Chair Powell signals an even faster clip of rate hikes ahead,”

BofA adds.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.