Yields are on the march once again.

US 2-year yields are up 8.4 bps to 2.66%, which is a new cycle high.

The long end is still below yesterday’s highs but 30-year yields have climbed to 2.97% from 2.89% at the start of US trading. It’s a straight-line move across the bond curve with yields up 10 bps.

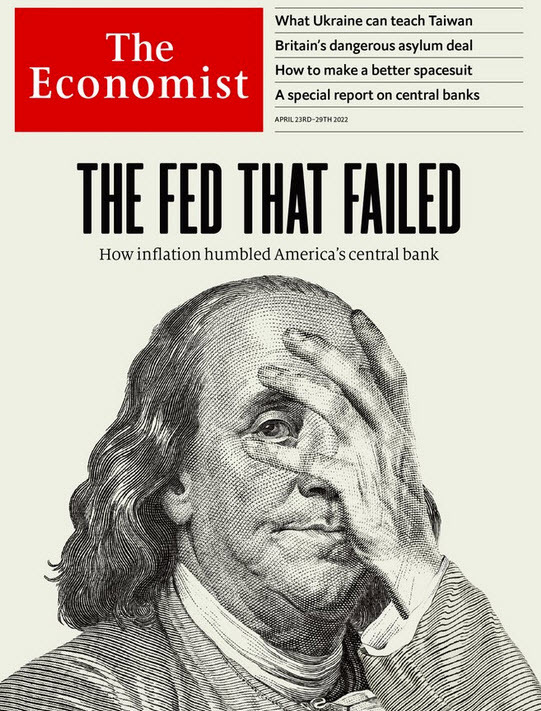

Though I have to wonder if this cover from The Economists signals that we’re at the peak of inflation worries:

In any case, the stock market doesn’t like what it’s seeing from bonds. The S&P 500 has pared its gain to 26 points, which is half of the best levels of the day.

In terms of FX, the change in mood is weighing most-heavily on commodity currencies and GBP, which are falling fast.

This article was originally published by Forexlive.com. Read the original article here.