The USDJPY moved to a new cycle high (and highest level since 2020) in the Asian session with a move up to 126.74. The high price from Friday reached 126.67 before modestly retracing into the close. The Good Friday closing level was near 126.40. The current price is trading at 126.56 with the swing low price in the Asian session reaching down to 126.23.

As outlined in a post on Friday, traders who have sold because the USDJPY is overbought, have had to deal with progressively higher levels on most trading days. One of the main catalysts is the yield spread between US and Japan yields are continuing to rise as US Federal Reserve policy is focused on raising rates, while the BOJ is content to keep rates where they are (and suppressed longer term rates in the process).

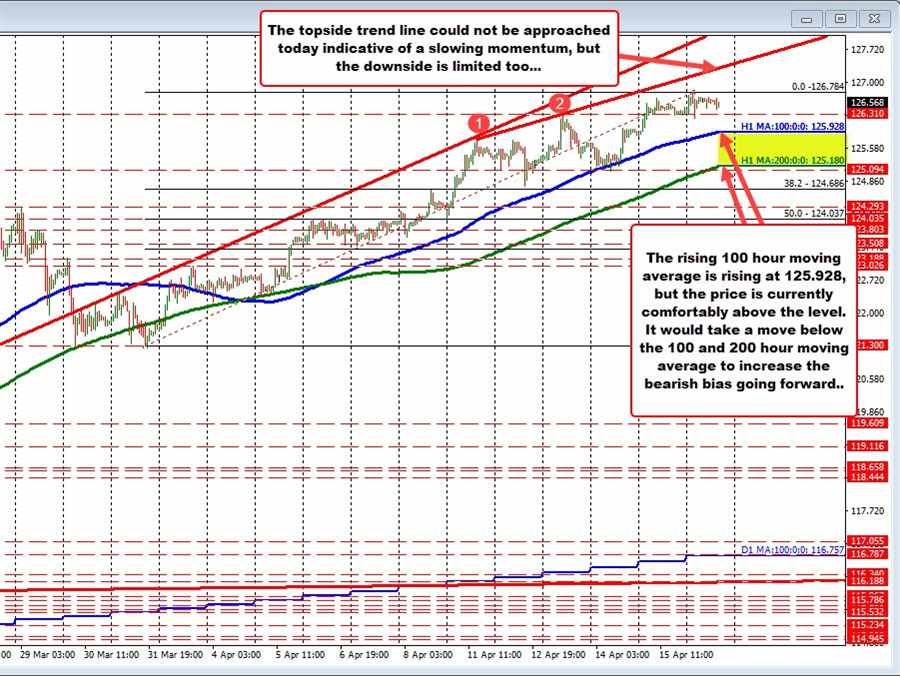

Admittedly, the momentum to the upside is slowing a bit . The topside trendline on the hourly chart above has NOT been tested today (see hourly chart above).

Looking at the 5 minute chart below, the price action has been trading above and below its 100 and 200 bar moving averages (blue and green lines in the chart below). However, of note intraday, is that the last move to the upside has seen some sellers against the near converged moving average levels. That gives the shorter-term intraday bias a small tilt to the downside. Be aware for the little nuances from the 5 minute chart chart for potential clues.

Overall, the more consolidative trading has allowed for the 100 hour moving average to continue to move closer to the current price (see blue line on the hourly chart above). That 100 hour moving average is still some 60 pips away from the current level (moving averages at 125.928). There is more work to be from the sellers.

Recall from last Thursday, the price did dip below the 100 hour moving average for the first time since April 1, but could not sustain downside momentum (there was support near the swing high from March 28 that held support).

If the sellers are to be taken seriously, getting -and staying below – the 100 hour moving average would be Step 1 off the hourly chart. Step 2, would be a move below the 200 hour moving average (green line in the chart above). Absent that, and the sellers are not taking back control. The trend would remain more bias to the upside at least in the intermediate term.