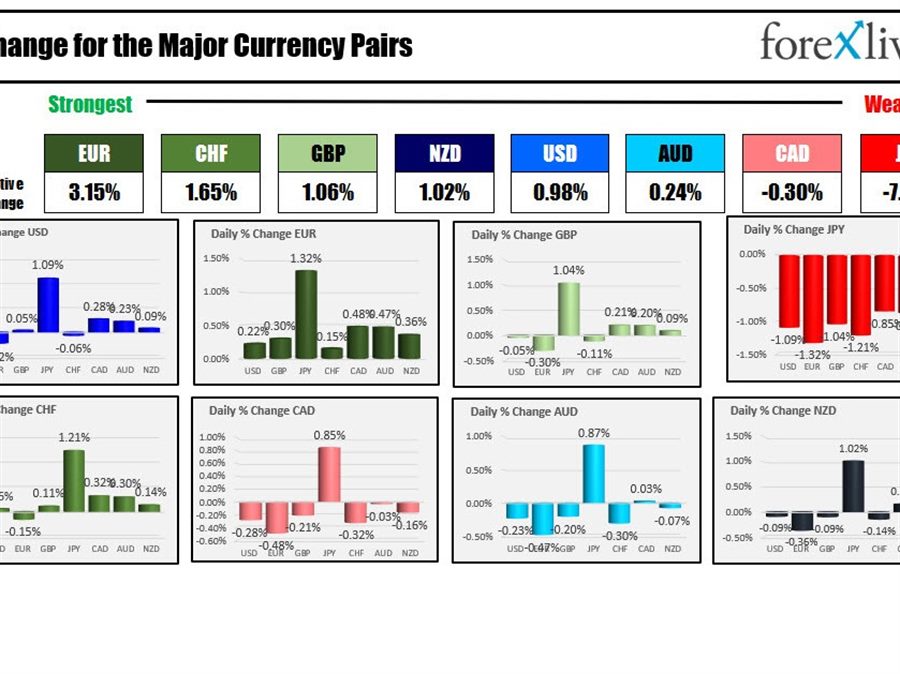

The EUR is the strongest and the JPY is the runaway weakest of the major currencies. The USDJPY is up over 1% on the day and in the process has extended to test the swing high going back to June 2015 at 125.851. The price is trading at the high for the day at 125.74 currently. A move above that level will take the price to the highest level since May 2002.

US CPI will be released on Tuesday and PPI will be released on Wednesday. The CPI is expected to rise 1.2% on the month and to a new 40 year high at 8.5%. The PPI is expected to rise 1.1% on the month and 10.5% YoY.

US yields are higher on the day with a rise of 2.7 to 4.3 basis points across the curve. US stocks are lower to start the week after major indices fell last week led by the Nasdaq index. Elon Musk will NOT join the Twitter board. Oil is down sharply. China covid lockdown continues in Shanghai as numbers continue to rise. Bitcoin is lower after weekend trading pushed the digital currency lower.

Macron and Le Pen will face off in two weeks after the weekend first round of elections in France. Le Pen has taken advantage of the higher inflation and Macrons proposal to raise the pension age.

A snapshot of the other markets shows:

- Spot gold is trading up $16.72 or 0.86% at $1962.45

- Spot silver is trading up $0.51 or 2.05% at $25.22

- WTI crude oil futures are trading at $93.69 down $4.57 or 4.66%

- Bitcoin is trading at $41,202. On Friday the digital currency closed at $42,290

In the US stock market, the major indices are off to a weaker start with the Nasdaq leading the way:

- Dow -145 points after Friday’s 137.55 point rise

- S&P is down -31.5 points after Friday’s -11.93 point decline

- Nasdaq is down -182 points after Friday’s similar -186.30 point decline

In the European stock market , the major indices are also trading lower with the exception of the France’s CAC after the weekend elections:

- German DAX, -0.8%

- France’s CAC, +0.4%

- UK’s FTSE 100 -0.55%

- Spain’s Ibex, -0.14%

- Italy’s FTSE MIB -0.32%

In the US debt market, yields are higher across the board with a flatter yield curve.

The benchmark 10 year European yields are also rising across the board. The 10 year bund yield has moved up to 0.819% which is the highest yield since September 2015 as are France 10 year yields.