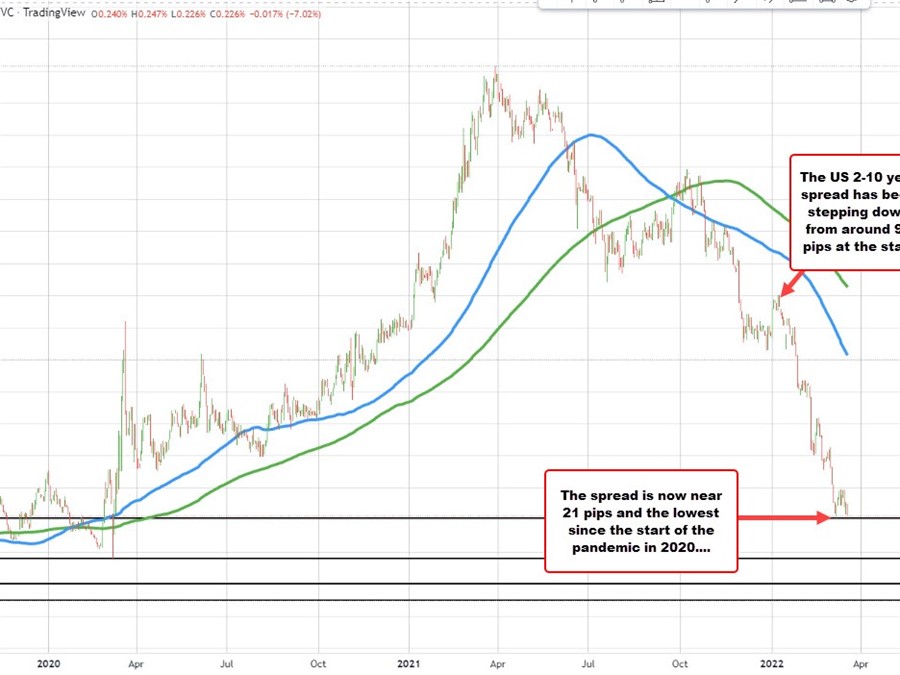

The US 2 vs 10 year spread ended the week near 21 basis points last week, and near the lowest levels since the start of the pandemic in March 2020. During that pandemic time period, the spread moved to a low of 8 basis points.

The spread in 2022 has seen a high of around 90 pips on January 10, but has stepped lower since then. The spike in inflation and the the reluctance of the Fed to address it, had traders feeling that the Fed was falling behind the curve. Ultimately, the Fed would have to act and do it aggressively, choking off the economy in the process.

The Russian/Ukraine war is certainly not helping at all as inflation from the supply shock is now being juiced by inflation from the war and it’s impact on commodities like wheat and corn, and nickel and oil. And we all worried it was just a matter of chips, and ships getting into docks and getting the goods distributed. Whoops.

Two or so weeks ago, Fed Chair Powell testified on Capitol Hill. When asked if he was willing to be like Volker to stop inflation. He answered “Yes” without hesitation.

Last Wednesday when the market was expected the Fed to “up” it’s tightening bias to 4-5 times in 2022, they went straight to 7 hikes in 2022. They now see the rate at the end of year at 1.90%. Powell indeed was a bit more Volker-esque.

The questions now for the markets are:

- Is it too still late?

- Is the Fed still behind the curve with regard to inflation?

- Will oil and other commodity rises lead to a cost/push inflation that feeds into expectations rising?

- Will the need to fight the fight on inflation tip the economy from boom to bust?

- What will that do to stock? to housing? to jobs?

There is no doubt that the recent history bulked up peoples investment accounts and the shortage of housing sent price skyrocketing as well. With investment accounts and home prices making consumers feel wealthy, it is believed that there is enough momentum to keep the economy going. Moreover, it was thought that if the Fed can make it through the rough patch and inflation DOES start to move back lower as the supply shock unclogs further and the Russian Ukraine war fizzles out, then happy days will be here again with rates more normalized and the balance sheet reduced as well. The Fed get’s out of jail.

However, there are also a ton of things that could go wrong too. The wall of worry was at one height pre-Russia/Ukraine. It is at a different higher height now.

The Fed screamed “uncle” last week with the hawkish dot plot, and the stock market rallied strongly.

However, the 2-10 year spread continued it’s move to the downside and closed near the low since March 2020. The bond market is saying the road ahead for the economy may not be all that great.

Traders will be watching that 2-10 year spread this week. If it continues to soften, look for the stock market to lose it’s enthusiasm as not only fears of slower growth start to show, but earnings estimates start to be ratcheted down as inflationary pressures squeeze earnings.

Housing? The supply thing may be solved by a demand thing as higher rates, and high prices take buyers out of the market.

Technically for the broad US indices this week,

- The S&P is opening the week near its 200 day MA at 4470.51. Watch that level. If it moves above, it’s good, but if it moves above and comes back below, that would not be good. It’s 200 hour MA is down at 4354.29 currently. Pay attention to that level on the downside. .

- For the Nasdaq index it still has not made it back to the 38.2% of the move down from the November all time high at 13952.28. The price closed at 13893.84. The price needs to get and stay above that retracement to give the buyers some hope that the bottom is in. Absent that, and the correction is not even a plain vanilla variety (it is less than that). Watch that level. On the downside, the 200 hour MA was broken last week and is at 13536.00. Move back below that level and things won’t be looking good either.