- 12-month PCE inflation 3.1% vs 3.5% prior

- Six month annualized inflation 4.6% vs 3.9% prior

- One month annualized inflation 6.7% vs 4.6% prior

These numbers all show an acceleration in core inflation and that’s the kind of thing that will kick the Fed into a higher pace of rate hikes.

Owner-occupied home inflation rose 5.2% annualized and that was a large component within the trimmed mean. Healthcare inflation looks to be kicking up again as well, with prices up 10.3%. Large spikes that were trimmed included electricity, furniture and prescription drugs while vehicle rentals, air transport and hotels were all drags that were trimmed out (but not for long with omicron fading).

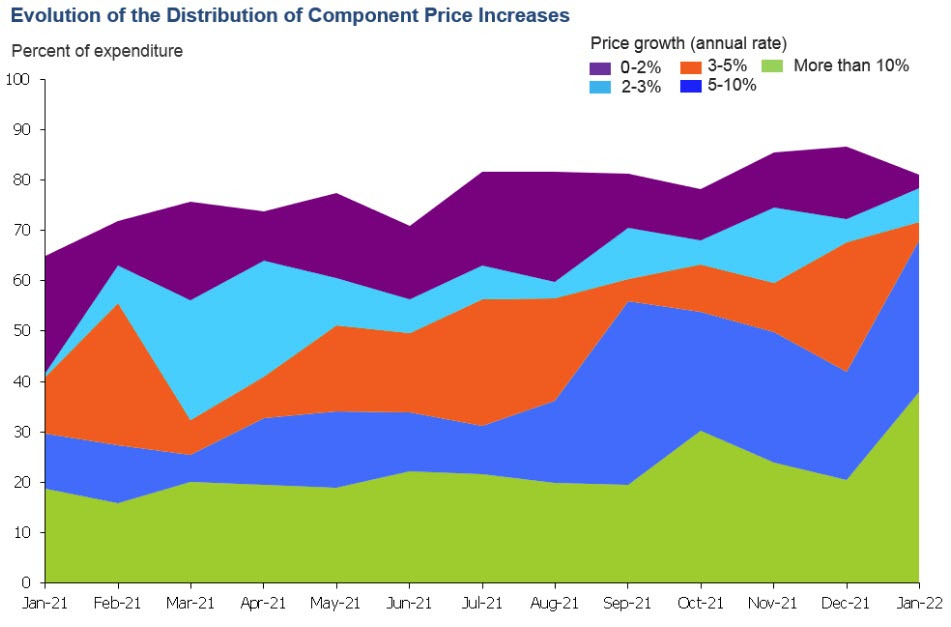

A look at the composition of this report shows even more reasons to worry about inflation.

This article was originally published by Forexlive.com. Read the original article here.