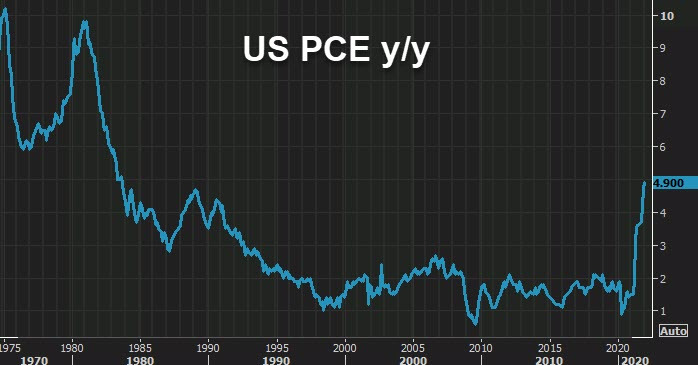

- Prior was +4.9% y/y

- Core m/m +0.5% vs +0.5% expected

- Prior core m/m +0.4%

- PCE price index +0.6% m/m vs +0.4% prior

- PCE price index +6.1% y/y vs +5.8% prior

Consumers spending and income for January:

- Personal income 0.0% vs -0.3% expected.

- Personal spending +2.1% vs +1.5% expected.

- Real personal spending +1.5% vs -1.0% prior

The omicron variant skewed some numbers in January and further tightened some supply chains but it didn’t slow down the consumer. Spending was strong and price hikes were pushed through. Some of that is via energy as gasoline prices rose in the month but overall this looks like an economy that can tolerate rate hikes. The Fed’s Waller was talking about a 50 bps rate hike earlier today and 6.1% y/y inflation won’t dissuade him.

This article was originally published by Forexlive.com. Read the original article here.