The Russian Parliament rubber stamped Russian President Putin’s request to deploy troops and invade SE Ukraine. Putin frames it as a way to protect and come to the aid of the Russian separatists in Bonestsk and Luhansk after declaring them independent, but NATO sees it as an invasion of at least part of a nation (and who knows where it might end).

The actions by Putin/Parliament led to Pres. Biden to announce the start of US sanctions against two Russian banks, on elites and some high up Russian family members, and on Russian sovereign debt. Including the sovereign debt would cut Russion off from financing from the West. Also Germany said that they reevaluate the NordStream 2 pipeline, and the EU and Britain also imposed similar sanctions including separatist imports and exports.

US Secretary of State announced that he would not be meeting with Russia’s Lavrov.

The pressure is on. Let the battle begin.

The news pushed stocks lower with the major US indices showing declines of 2.2% for the Nasdaq, -2.10% for the Dow and -1.88% for the broad S&P. just ahead of the Biden speech.

However, those losses were retraced more than 1/2 of the declines after the speech, only to reverse back lower into the close.

At the end of the day, the:

- Dow closed down -1.42%

- S&P fell -1.01%

- Nasdaq fell -1.23%.

The Dow and Nasdaq have now fallen 4 consecutive days. The S&P is on a 3 day losing streak.

In other markets,

- Gold traded above and below the $1900 level and closed just below that level at $1899

- Crude oil reached as high as $94.95, but did back off to $91.61 near the end of day

- Bitcoin rose to $37988 after trading as low as $36368 at the session lows

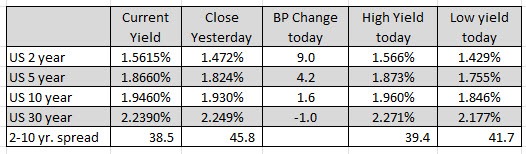

In the US debt market, the US yields moved sharply higher on the short end in particular despite a strong 2 year note auction today. The 2 year is up 9 basis points at 1.5615% after trading as low as 1.429% overnight on flight to safety flows. While Russia/Ukraine remains a global issue filled with uncertainty, the Fed”s Bowman hinted that she might be in favor of a 50 basis point hike in March.

Economic data today was mostly supportive of a strong economy as Case Schiller home prices remain elevates, the flash services PMI moved up to 56.7 vs 53.0 expected, and US consumer confidence moved to 110.5 vs 110.0 expected.

In the forex market, the flow of funds were a bit counter to “risk off’ expectations on war risk. The NZD and AUD were the strongest of the majors, while safe havens like the CHF, JPY were the weakest.

The USD is ending the session mixed with gains vs the CHF and JPY and losses vs the NZD and AUD. The other currencies vs the greenback are ending the day near unchanged.