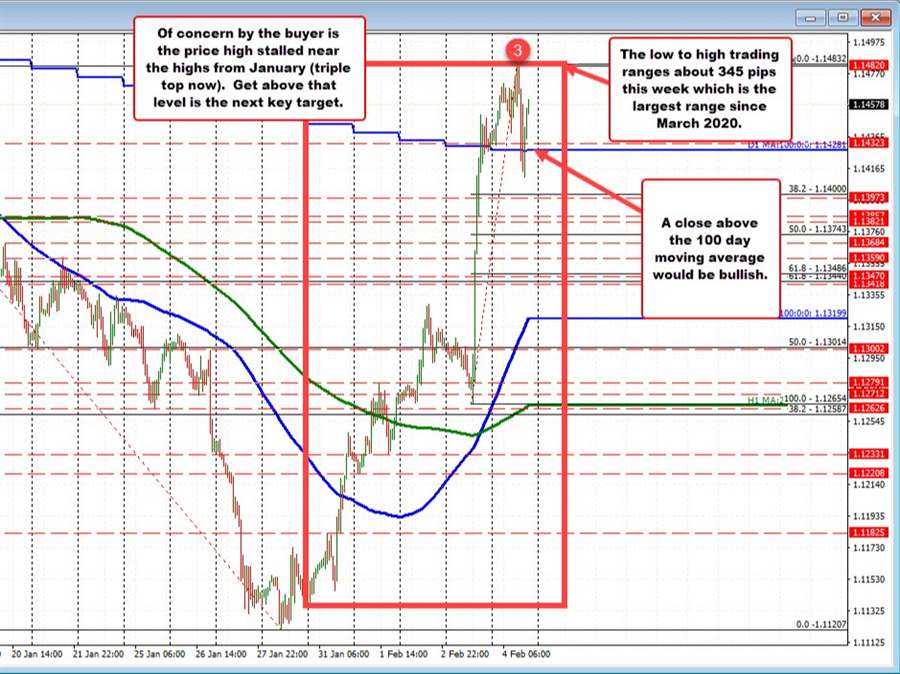

The EURUSD moved lower after the US jobs report. The price extended back below its 100 day moving average at 1.14281 the low price reached 1.1411 before bouncing back higher over the last few hours (see hourly chart above).

That rebound back to the upside has now moved the price back above the key 100 day moving average. The current price is trading at 1.14583, and is trading at the highest level since the jobs report..

A close above the 100 day moving average today would be the first close above that key moving average since mid June 2021.

Earlier today, the price high for the day at 1.14832 was able to extend briefly above the January 14 high price at 1.1482 and the January 13 high price of 1.14811.

Needless to say getting above those three highs would be needed to open the door for further upside momentum.

With the price now above the 100 day moving average again, that moving average is now a close risk level for the pair. Stay above keeps the buyers in control.

For the trading week,

- the low for the week happened in the first few hours of trading on Monday.

- The low reach 1.1137 at that time.

- Today is working on the fifth straight day to the upside.

- The low to high trading range of about 345 pips is the largest trading range since March 29, 2020.

- The highest trading range in 2021 was 300 pips.

- In 2020 after March 29, the highest range was 293 pips.

So the trend week to the upside this week has been one of the strongest in close to two trading years.

Taking a broader look at the daily chart, a move above the triple top at 1.1482 area would have traders targeting the 1.15125 to 1.15236 swing area (see red numbered circles).

Following that the 38.2% retracement of the move down from the 2021 high in early January 2021, to the January 2022 low comes in at 1.15898. Those would be the next targets on the topside going forward.

The moves this week for the pair was boosted technically by the failure of the break below the 2021 low at 1.11853. The move above a swing area between 1.1369 and 1.13857 was also a technical boost (as could be the move above the 100 day moving average – we will see).

Fundamentally, the ECB’s tiltd toward a potential tightening in 2022 yesterday, was reason to buy the beaten-down currency. Although the US is likely to tighten more than in ECB in 2022, the USD has seen a move down from 1.23488 at the beginning of 2021 to the low of 1.11207 this year. So there is some reason to believe in a corrective move higher based on the pricing in of the US hikes already..

PS. Looking at the weekly chart the EURUSD is approaching the 200 week MA at 1.1500. Be aware of that level in the new week too… Key level.