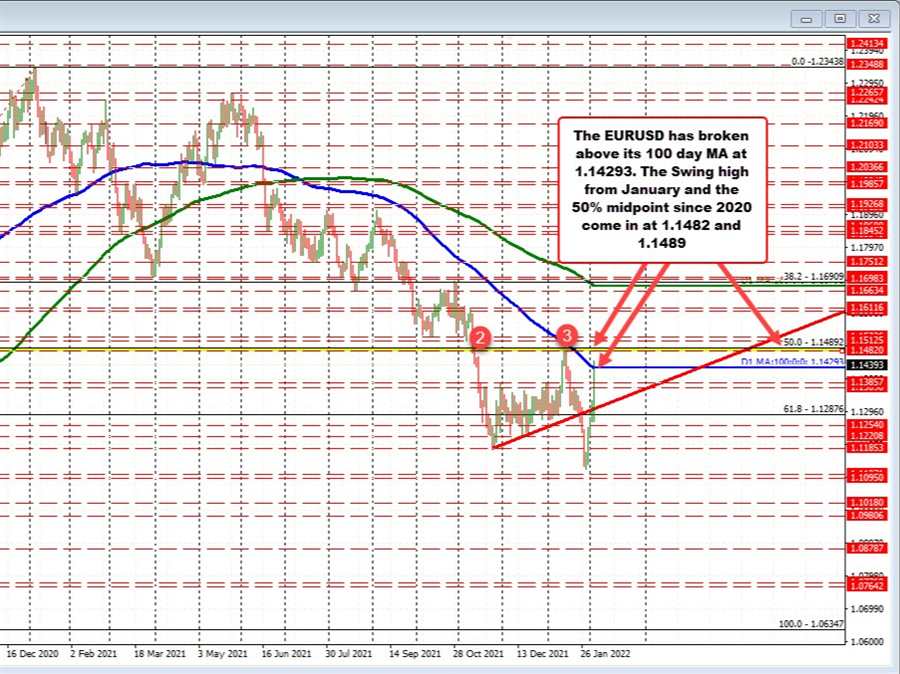

The price of the EURUSD continues its run to the upside and as extended above its 100 day moving average for the first time since June 16. The next target is the high from January 13 at 1.1482. That is near the 50% midpoint of the range in the EURUSD since 2020. (see earlier posts HERE and HERE)

The EURUSD has been boosted by expectations that the ECB will indeed look to raise rates in 2022. Lagarde did not rule out a hike (she has in the past). Sources comments that policymakers see March policy change if inflation doesn’t ease although they see tapering as the first option.

The benchmark German 10 year yield is rose to a high yield of 0.159% which is the highest level since March 2019..

This article was originally published by Forexlive.com. Read the original article here.