Morning all,

Equities went gangbusters yesterday, with the S&P 500 rising

1.9% on a steady advance, paced by the growth stocks. The Nasdaq Composite

(+3.4%) and Russell 2000 (+3.1%) outperformed with solid gains of over 3.0%.

Given the dire January, many have been keen to point to month-end

rebalancing as the prime reason for this upside move. Technicians will be

buoyed by the fact that SPX reclaimed it’s 200dma of 4437.

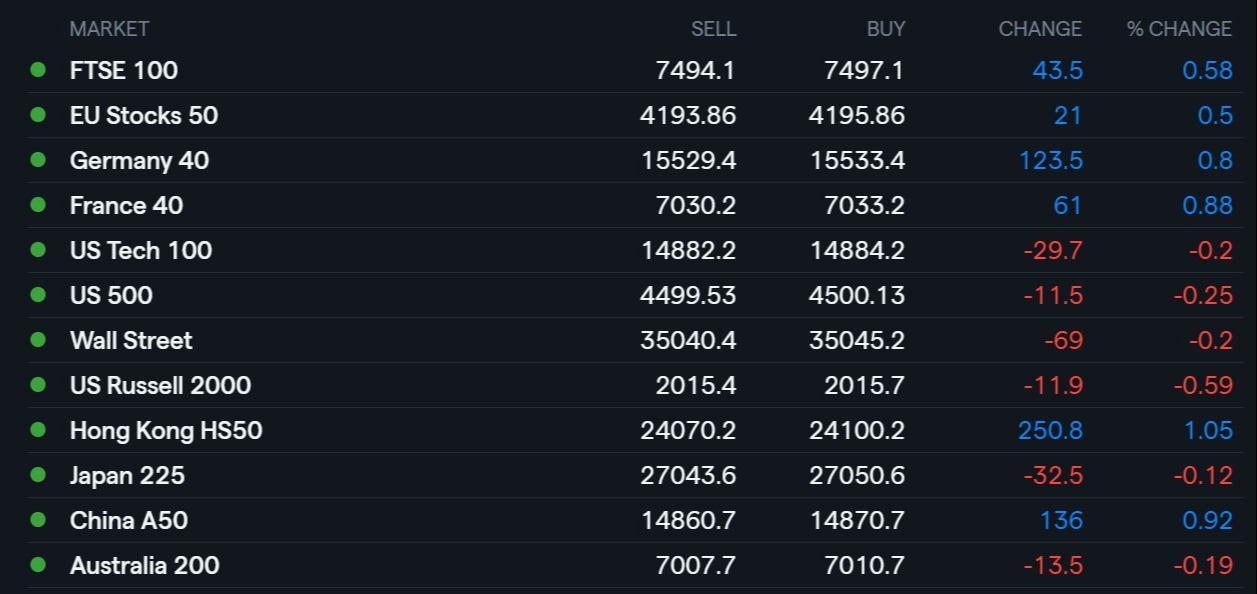

This upside, and the lack of Asian participants to dampen

the exuberance, means that all major European bourses are starting in positive

territory – Indicative prices have FTSE 100 up 0.6% and DAX up 0.8% as of 0620

GMT

As Newsquawk notes, Euro was bid thanks to the downside in

the buck, helping EUR/USD reclaim 1.12 while all eyes will be on the ECB rate decision

on Thursday with a focus on the inflationary outlook as we. At the same time,

the statement and other tools are set to remain relatively unchanged. Market

pricing has been leaning hawkish. Money markets are now fully pricing in a 10bp

hike by September and over 25bps by December amid a hotter than expected

inflation print for Germany across all metrics.

On the Fed Speaker front; Daly sees rate hike early March,

touts 1.25% rate by year-end; George expresses concern over yield curve; Bostic,

who got many in a flap with his 50bps comments in the FT over the weekend, felt

compelled to make an unscheduled statement (usually happen when they fear their

words have been misconstrued) says a 50bps in March is not his preferred

action; Barkin wants Fed to get ‘better positioned’.

Oil prices edged higher, trading near seven-year highs hit

last week, as investors bet supplies will stay tight, with a limited production

hike by major oil producers and a strong post-pandemic recovery in fuel demand.

Of course, the latest monthly Reuters survey of OPEC oil output for January showed

production rising by just 210kbpd MoM to 28.01mbmd, led by rises in Saudi Arabia

while output fell in Libya and Iraq, which is barely 50% of the pledged 400k

hike in output. To the annoyance of Crude bears everywhere.

For UK PM Boris, ‘wait for the Sue Gray Report’ has become ‘wait

for the Met Police Report’ – If the betting markets are anything to go by, and

for sentiment, they usually are, Boris is through the worst. The market now eased

to almost a 50% shot that he’s still around at the Tory Party Conference in the

first week of October

Perhaps as a guide to just how toxic Westminster is for the

PM right now, he’s opted to fly to Kyiv for talks with President Volodymyr

Zelenskyy.

Coming up in the European session, we have German Retail

Sales and Unemployment data, UK Mortgage numbers, plus a raft of Manufacturing PMIs

from the continent – Most important, in my humble opinion, is the French CPI data, which we are expecting to print deflation (-0.2% on the MoM) rather than inflation.

Of course, as we should all know by now, inflation is the entire ballgame right

now, with its direct impact on monetary policy.

Keep it tight!