From time to time, a big cap earnings report can calm the markets nerve and offer a reason for optimism.

That time won’t be today, unless you believe that a once-dominant company that blew the most-attractive secular trend in the world has somehow regained its form.

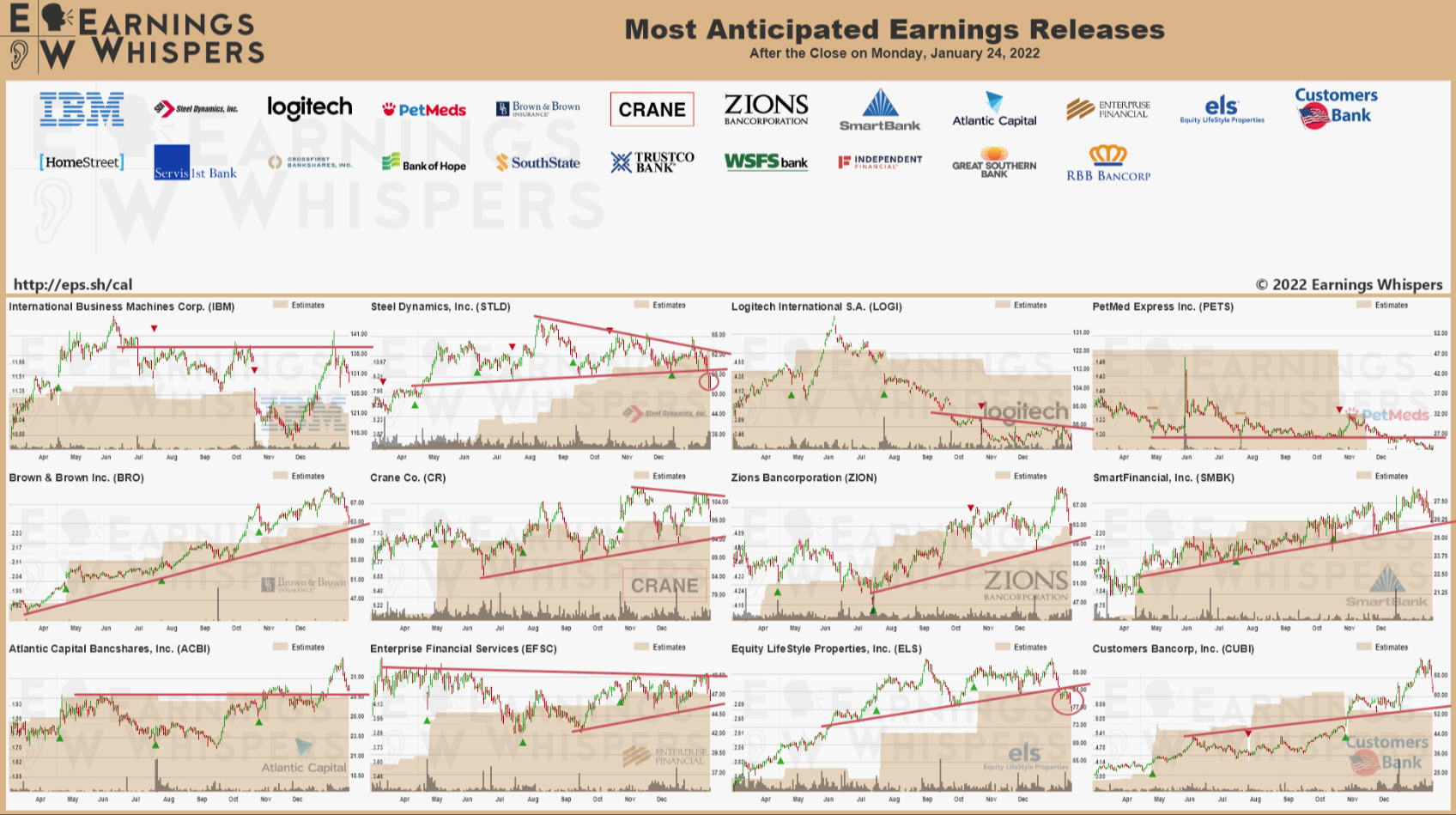

The big company on the earnings list today is IBM, which is trading below where it was 21 years ago.

If you don’t like that, you can wait until the pre-market tomorrow when the formerly world’s largest industrial company that squandered almost everything reports, with GE on the docket.

One to watch tomorrow will be American Express for a view on consumer spending and chargeoffs.

Coming up in FX, we get Australian Q4 CPI later today and tomorrow we get US consumer confidence.