The early-week US economic highlight will be CPI and that will dominate the conversation until it’s released but on Friday there could be a new set of worries with the release of December retail sales.

The consensus is +0.1% on the headline, +0.3% excluding autos and +0.2% on the control group.

Bank of America has tabulated its credit card spending data and thinks it will be much worse. They’re forecasting -1.3% on the headline, -1.6% ex-autos and -2.1% on the control group.

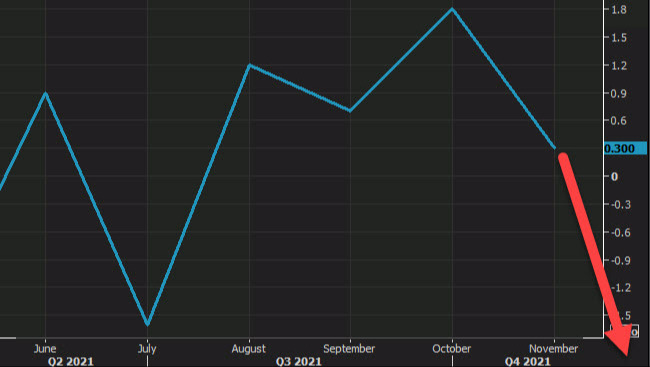

Part of the reason is something I’ve been writing about for years — that holiday shopping is being done progressively earlier. That was especially the case in 2021 as consumers were warned about shipping delays and bottlenecks. That factor exaggerated gains in October (+1.8%) and December will be the payback.

They also note that restaurant spending slowed sharply in December as omicron hit, suggesting consumers are hunkering down.

Restaurant spending growth decelerated to 5% on a 2-yr basis, likely on concerns around the Omicron variant pic.twitter.com/q18o5RbSY6

— Mike Zaccardi, CFA, CMT (@MikeZaccardi)

In previous covid waves, consumers could rely on government handouts but

this time, spending among income groups earning less than $50K has slowed noticeably.

Credit card spending slowed noticeably on a 2-yr basis for the lower income group while debit card spending remained steady pic.twitter.com/bF8eZJtGpw

— Mike Zaccardi, CFA, CMT (@MikeZaccardi)

As more credit card data is released and economics lower estimates, that could add to the risk averse tone.