Changes for the week are mixed

The major European indices are closing the day lower led by declines in the Spain’s Ibex and Italy’s FTSE MIB. The move to the downside were triggered by fears of the Covid resurgence. Austria announced that they would lockdown starting Monday and require vaccinations. Other levels of resurgence in Covid cases are happening on the continent,, boosting fears of an economic slowdown.

- German DAX, -0.3%

- France’s CAC, -0.36%

- UK’s FTSE 100 -0.4%

- Spain’s Ibex, -1.6%

- Ital in Covid cases ‘s FTSE MIB -1.1%

For the trading week, the indices France’s CAC and German Dax moved higher while the other indices move to the downside. Both the CAC and the DAX reach new all-time highs this week before backing off.

- German DAX +0.49%

- France’s CAC, +0.35%

- UK’s FTSE 100, -1.65%

- Spain’s Ibex, -3.5%

- Italy’s FTSE MIB, -1.4%

in other markets as London/European traders look to exit:

- Spot gold is trading down $1.30 or -0.07% at $1857.26

- Spot silver is trading up nine cents or 0.36% at $24.86

- WTI crude oil futures are trading down $-3.44 or -4.36% at $75.41

- Bitcoin is trading higher by about $1000 of $58,032

In the US stock market, the S&P and NASDAQ are on track for record closes. The Dow industrial average is a lower:

- Dow industrial average -166 points or -0.47% at 35702.26

- S&P index +5.32 points or 0.11% at 4709.98. The all-time high price for the S&P index is at 4718.50. It’s high price today has so far reached 4710.88

- NASDAQ index +117.77 points or 0.74% 1611.79. The NASDAQ index traded to an all-time high price today

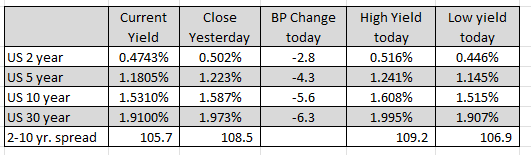

In the US debt market as London traders look to exit, yields are lower with a flatter yield curve. The two – 10 year spread as moved into 105.7 basis points from 108.5 basis points near the close yesterday.

IN the forex, the JPY is the strongest of the major currencies while the EUR is the weakest. That was the ranking when US stock trading began.