Risk aversion hits markets

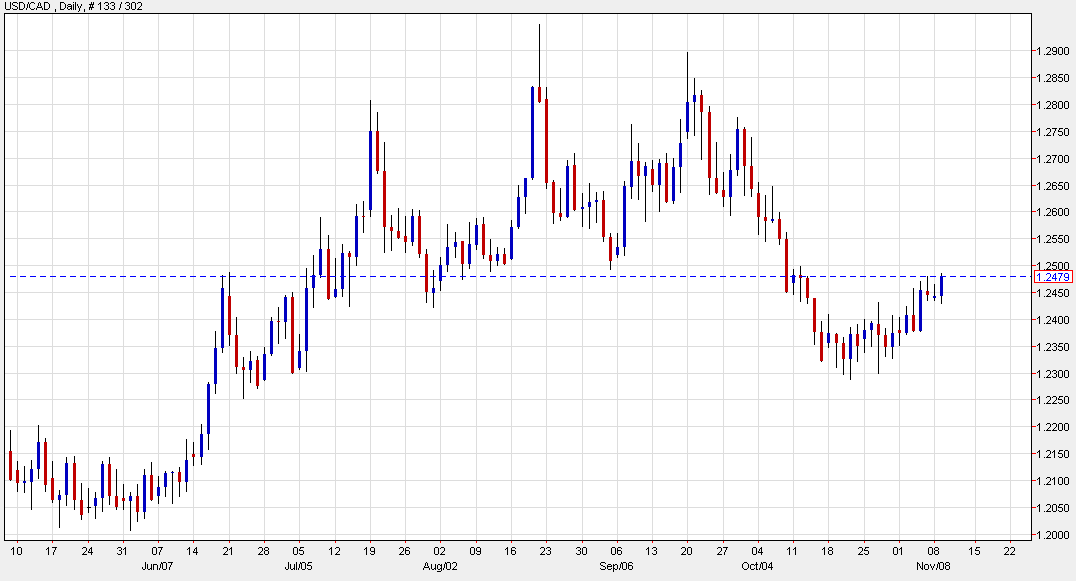

A drop in equities has led to a quick risk-off style move in FX as the US dollar and yen rally against other currencies. The commodity currencies are being hit hard with the loonie jumping 38 pips to 1.2476.

Oil has been surprisingly resilient in the latest round of worries but natural gas is down 6.3%. The pop in USD/CAD is the highest in four weeks and is back to within striking range of the key 1.2500 level.

The takeaway for me at the moment is just how jittery the broad market is. A dip in Tesla shares triggered a mini run to the exits and that quickly spilled into FX. It’s like everyone is long but ready to bail at the slightest hint of pain. That’s the kind of market psychology that can lead to a rout.

This article was originally published by Forexlive.com. Read the original article here.