UK’s FTSE 100/Spain’s Ibex are lower

The major European indices are ending the session with mixed results. The provisional closes are showing:

- German DAX, flat

- France’s CAC, +0.4%

- UK’s FTSE 100 -0.4%

- Spain’s Ibex, -1.0%

- Italy’s FTSE MIB +0.5%

In other markets, as London/European traders look to exit shows:

- Spot gold is trading down $24.65 or -1.38% at $1762.76

- Spot silver is down $0.32 or -1.37% at $23.18

- WTI crude oil futures are down around three dollars or -3.56% at $80.92. The low price reached $80.66 between a swing area between $80.58 and $80.78

- Bitcoin is trading down $875 at $62,380

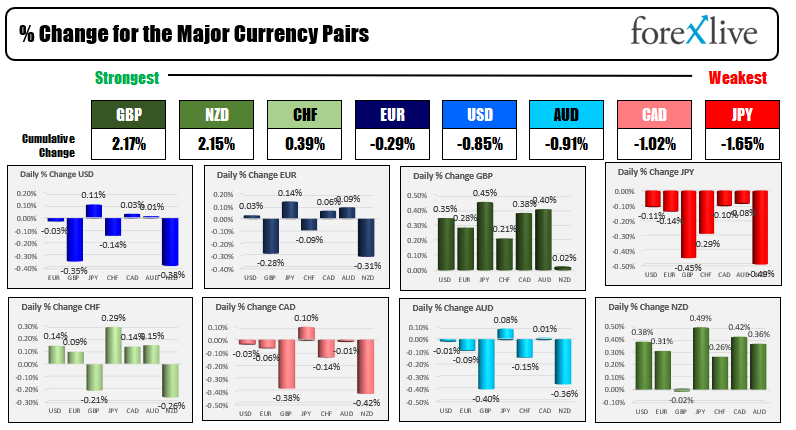

In the forex market, the GBP is fighting with the NZD as the s strongest of the majors. The JPY is the weakest. The USD is mixed with marginal gains and losses versus the EUR, JPY, CHF, CAD and AUD. The greenback is lower verse the GBP and NZD. The market is awaiting the FOMC decision at 2 PM.

In the US stock market, the major indices are mixed with the Dow and S&P lower while the NASDAQ is marginally higher. All three indices close at record levels yesterday:

- Dow industrial average -103 points or -0.29% at 35949.76

- S&P index -3.84 points or -0.08% at 4626.74

- NASDAQ index up 21 points or 0.13% at 15671

In the US debt market, the yields are higher with the exception of the 30 year. The five year is up 4.7 basis points.

In the European debt market, the benchmark 10 year yields are mostly marginally lower with the exception of the UK 10 year which is up 3.5 basis points.