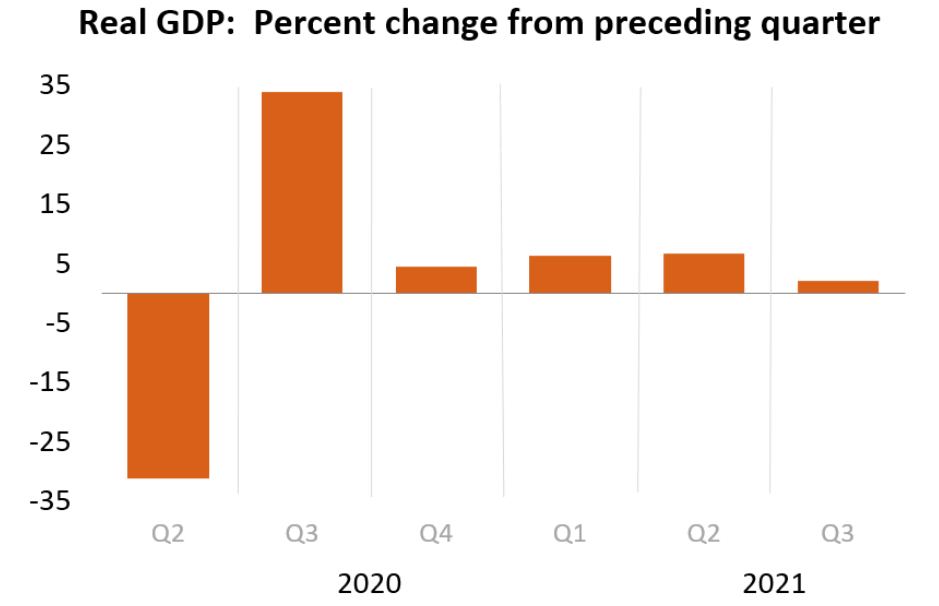

Highlights of the first look at Q3 GDP

- Q2 was +6.7% annualized (unrevised)

- Q1 was 6.4% annualized

- Personal consumption +1.6% vs +12.0% in Q2

- GDP deflator +5.7% vs +5.5% expected

- Core PCE +4.5% vs +4.5% expected

- GDP final sales -0.1% vs +8.1% in Q2

- Full report

Details:

- Inventories added 2.07 pp to GDP vs -1.26 pp in Q2

- Inventories cut -2.62 pp in Q1

- Exports -2.5% vs +7.6% second reading

- Imports +6.1% vs +7.1% second reading

- Trade was a 1.14 pp drag vs 0.18 pp drag in Q2

- Home investment -7.7% vs -11.7% in Q2

- Consumer spending on durables -26.2% vs +11.6% in Q2

- Personal consumption added 1.09 pp GDP vs +7.92 pp in Q2

- Government spending added 0.14 pp to GDP vs +0.36 pp in Q2

- Full report

Economist Julia Coronado notes that excluding motor vehicles, GDP grew at 7.4%. The demand is there for cars so this shows that it’s largely a chip-shortage phenomenon.

Viewing

Touch / Click anywhere to close

This article was originally published by Forexlive.com. Read the original article here.