Euro Stoxx index comes off a record close reached yesterday

The major European indices are closing lower on the day. It comes a day after the Euro Stoxx 600 index closed a record level yesterday. Today, the index was down -0.1%.

Other provisional closes shows:

- German DAX, -0.4%

- France’s CAC, -0.2%

- UK’s FTSE 100, -0.3%

- Spain’s Ibex, -0.3%

- Italy’s FTSE MIB, -0.5%

In other markets as European traders move toward the exits for the day:

- Spot gold is trading marginally lower at $1792.40.

- Spot silver is down eight cents or -0.31% at $24.07.

- WTI crude oil futures are trading at $83.32 down -1.57%

- The price of bitcoin trades at $59,000

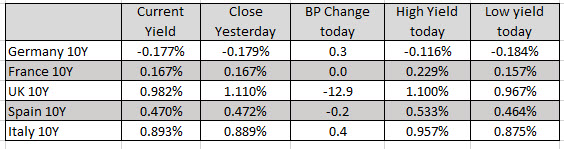

European benchmark 10 year yields are closing mixed in up and down volatility. The UK 10 year yield is down the most at -12.9 basis points but France (unchanged), Germany (+0.3 basis points), and Italy (+0.4 basis points) saw yields close marginally higher (but well off high levels as well).

In the US debt market, the yield curve flattened significantly with the 2– 10 year spread down to 106.7 versus 113.4 near the close yesterday.

The lower yields have helped to buoy the NASDAQ index today. It is currently leading the way with a 0.44% gain. The Dow industrial average is lower by -0.26%

- Dow industrial average -91.85 points or -0.26% at 35665

- S&P index +0.71 points or 0.02% at 4575.40

- NASDAQ index up 70.75 points or 0.46% at 15306.03

The more hawkish Bank of Canada has propelled the CAD to the top of the strongest to weakest major currency table. The BOC announced they will stop the bond buying and looks toward tightening in the two middle quarters of 2022 (vs the second half of 2022). The GBP is the weakest of the majors as European traders exit.

- durable goods in the US decline but the decline was better than expectations (-0.4% versus -1.1%).

- The US trade balance soared to a new record of $96.3 billion. That is a negative for GDP.

- Wholesale inventories increase by 1.1%.

- The crude oil inventory data showed a 4.3 million build versus expectations of 2.0 million.