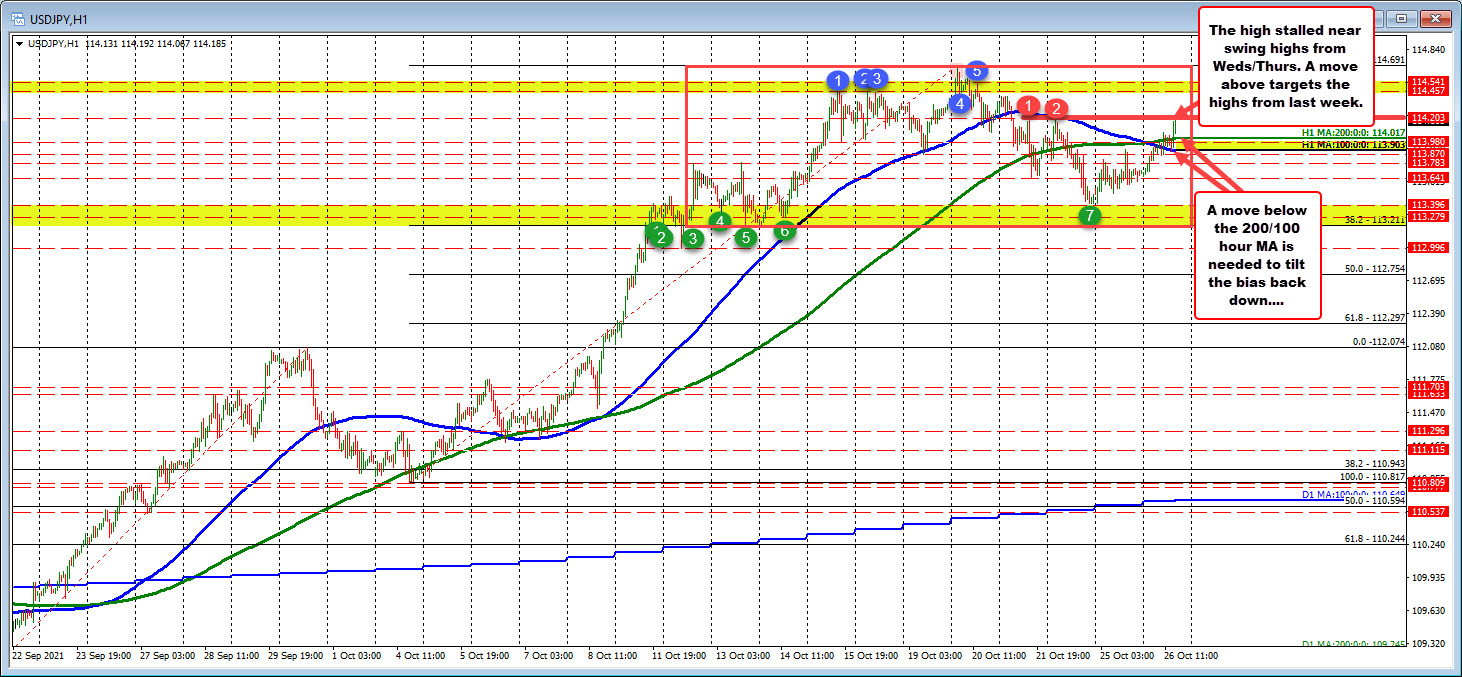

The price is above the 100/200 hour MA

The USDJPY has pushed to the upside in trading today helped by buoyant stock trading. The move has inched above the 100/200 hour MAs at 113.90 to 114.017. The last 7 or so hours have been able to hold above the low of that area. The current price is above the MAs with the price at 114.156 currently.

The high for the day is stalling near swing highs from last Thursday/Friday at 114.203. The high price today reached 114.199 and has backed off (but remains above the 200 hour MA so far).

Taking a broader look at the daily chart, the price has moved back above the October to December 2018 highs between 113.704 and 114.544. Last week the index traded above the 114.544 level to a high of 114.691. That was just below the 2017 high price of 114.728 (not shown).

The subsequent swing to the downside took the price below the its lower swing high level at 113.704 on Friday and again yesterday (the low reach 113.408), but the price rebounded higher today and trades between the swing high levels. Technically, as long as the price can remain above the 113.704, the buyers are still well in control and pushing to new highs is certainly not out of the question. A move below conversely would weaken the technical picture at least in the short term.

The Dow and S&P reached new intraday all-time highs today which tends to help the JPY pairs move higher (sends flows out of the relative safety of the JPY). The NASDAQ index is less than 0.22% away from its all-time high of 15403.44.