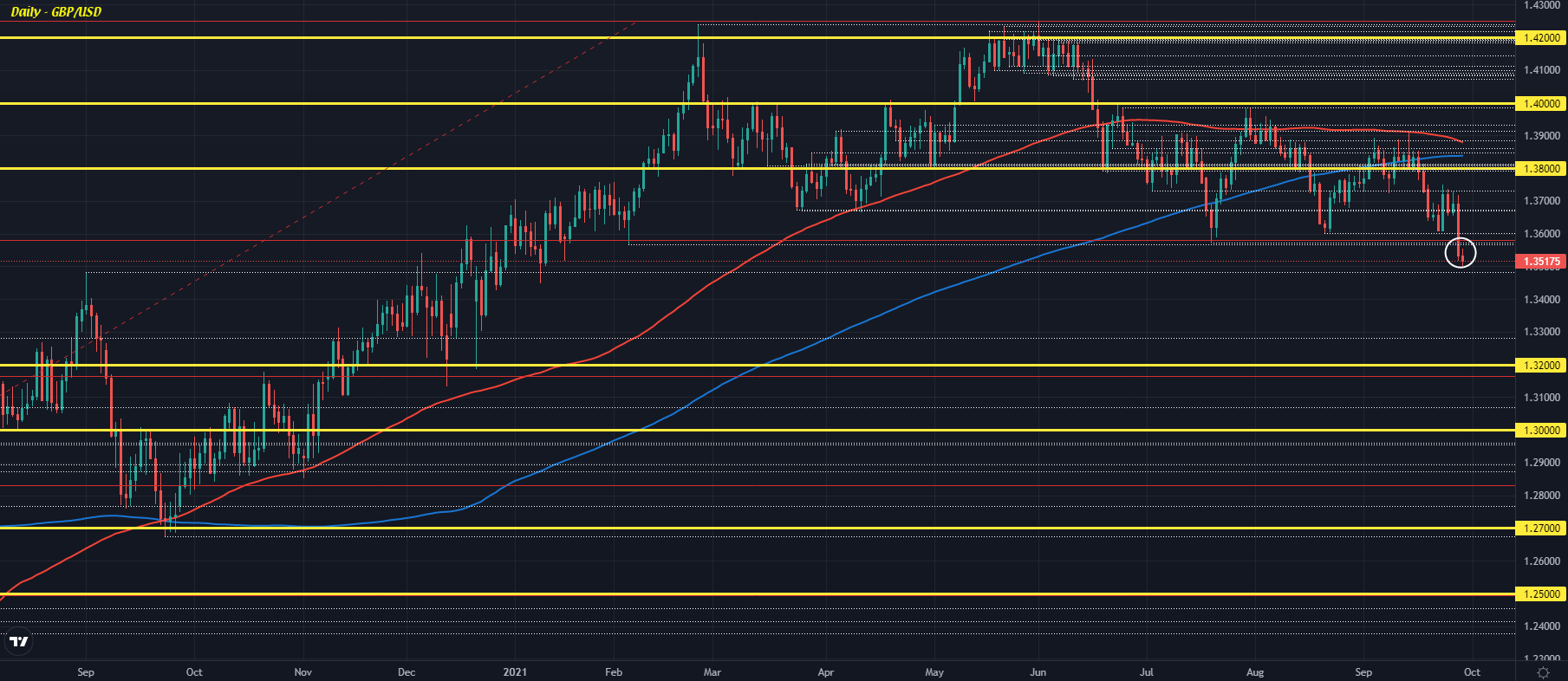

GBP/USD falls to a low of 1.3505, its lowest since 13 January

The break to the downside below the July low in trading yesterday is a big win for sellers from a technical perspective and there are little signs of an immediate bounce back for the time being, as the pair slips closer to the 1.3500 level.

There are plenty of things to ponder when it comes to cable now with the pound side of the equation having to weigh up stagflation risks and the BOE potentially needing to hike rates before year-end to prevent that from taking shape.

Meanwhile, the dollar side of the equation is more heavily tied to yields and risk sentiment at the moment as the market is captivated by the global energy crisis.

But perhaps the simplest way to approach cable is to view things from a technical perspective and that is clearer on the weekly chart:

The pair looks to have broken through key support below the July low and 1.3600 level, even breaching the 23.6 retracement level of the upswing from March last year to May this year, seen at 1.3580.

That puts a lot of room for the pair to roam to the downside, with perhaps the 1.3200 level and the key weekly moving averages at 1.3157 and 1.3240 providing the next key area of support for the pair, all things being equal.