Plenty of bravado out there

On the one side, there’s an army of China alarmists warning that Evergrande’s looming default is a Lehman moment for China’s property market.

On the other, there are those brushing it aside, confident that China will bail out whoever needs bailed out and keep the economy strong no matter what.

The author argues that stabilizing the property market will be “long, arduous and risking” with “a protracted construction slump.”

That has obvious knock-on effects to the consumer, mining and the global economy.

What bothers me about everything about China (including this thread) is that China is a blackbox. I’ve heard it all in the last 15 years and predictions about China almost never come true, even from the best-informed people.

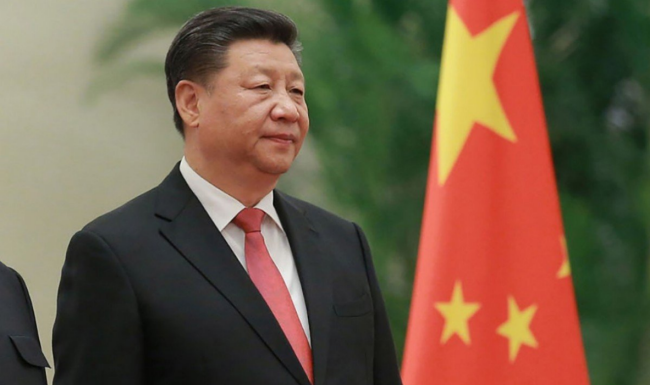

What worries me moreso than Evergrande itself is the clear shift from China’s Communist Party towards being more of ‘communist’ party. The crackdowns on billionaires and celebrities. The increased sensorship. Banning children from playing video games. It’s the threat that a shift towards ‘common prosperity’ will mean a de-emphasis on growing the pie and more on sharing it.

So while Evergrande itself my not be a systemic problem, a shift to a new lower-growth regime would change the long-term trajectory of the global economy.