Gold spins its wheels again

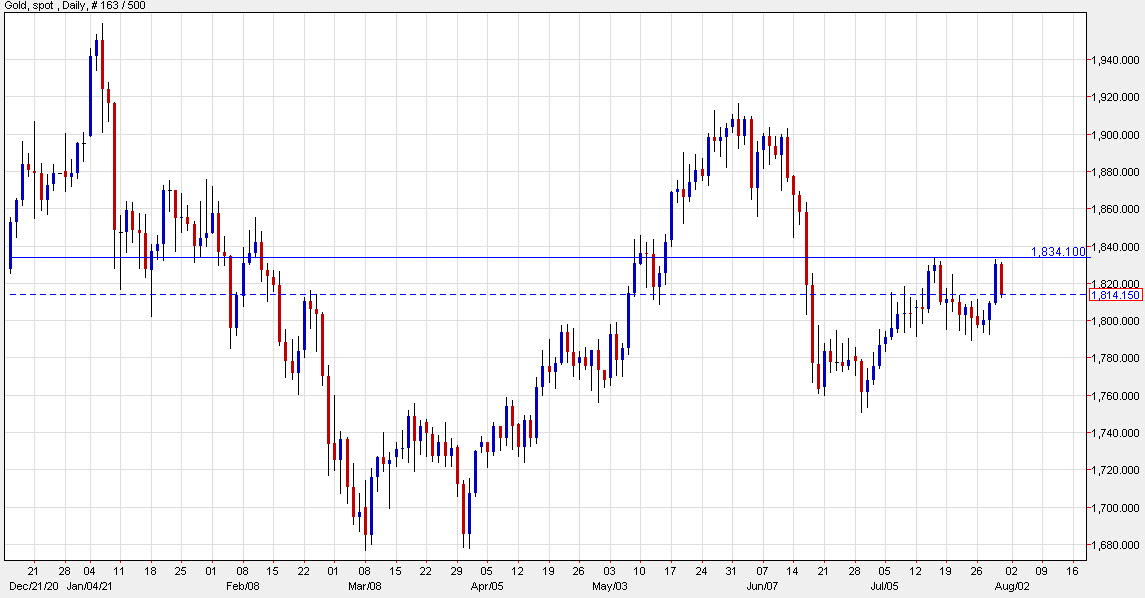

The $1834 resistance level and some moderate US dollar buying today spelled trouble for gold today, even with yields dipping another 3 bps today.

Technically, that’s a simple setup but it’s not necessarily bearish so long as last week’s low of $1790 holds.

On the fundamental side, Powell’s comments this week gave the market some comfort that there is no rush to hike rates. That sparked two days of gold buying but given that it’s month end and the tone in markets is more cautious, we’re seeing some caution.

At some point, something needs to happen to capture the imagination of gold bulls and it’s tough to find at the moment. My best bet is that inflation numbers begin to fall. Today’s PCE report showed it flattening out and I expect it to fall in the months ahead. There’s even a case for arguing there will be a significant undershoot on inflation a year from now, but that’s a long time to wait.